Bernstein Begins Coverage of CAVA Group with Cautious Outlook

Analyst Price Targets Calculate Downward Potential

Fintel reports that on November 20, 2024, Bernstein initiated coverage of CAVA Group (NYSE:CAVA) with a Market Perform recommendation.

Analyst Price Forecast Indicates 13.69% Decline

As of October 22, 2024, the average one-year price target for CAVA Group is $120.55 per share. This prediction varies, with estimates ranging from a low of $95.95 to a high of $141.75. These average projections reflect a potential decrease of 13.69% compared to its last closing price of $139.66 per share.

Check out our leaderboard showcasing companies with the most potential price target upside.

Projected annual revenue for CAVA Group stands at $847 million, marking a decrease of 7.33%. The expected annual non-GAAP EPS is -0.07.

Institutional Investment Trends

What Does Fund Sentiment Look Like?

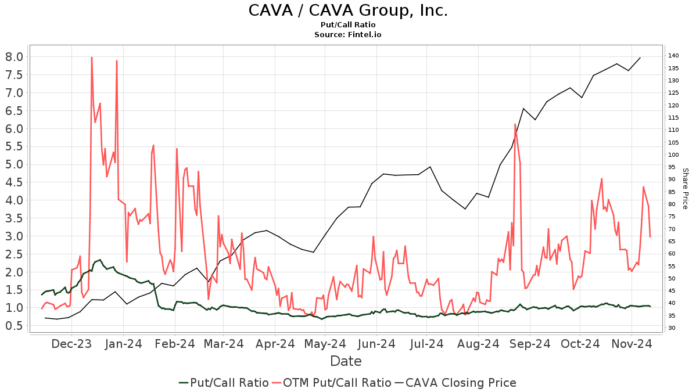

A total of 794 funds or institutions are currently reporting positions in CAVA Group, which reflects an increase of 119 owners, or 17.63%, over the last quarter. The average portfolio weight across all funds invested in CAVA is 0.36%, showing a rise of 6.16%. Over the past three months, the total shares owned by institutions grew by 0.10%, totaling 100,133K shares.  The put/call ratio for CAVA is 0.93, indicating a generally bullish sentiment amongst investors.

The put/call ratio for CAVA is 0.93, indicating a generally bullish sentiment amongst investors.

Artal Group currently holds 17,508K shares, equating to 15.28% ownership of the company. In its previous filing, the firm reported ownership of 23,508K shares, signifying a 34.27% decrease. However, it increased its portfolio allocation in CAVA by 63.76% last quarter.

SMCWX – SmallCap World Fund Inc. now holds 7,458K shares, which represents 6.51% ownership. Previously, this firm possessed 7,772K shares, amounting to a 4.21% decrease. Yet, it raised its allocation in CAVA by 31.02% in the last quarter.

D.E. Shaw holds 5,146K shares of CAVA, giving it a 4.49% ownership stake. This is up from 3,482K shares previously, representing a notable 32.33% increase in ownership. The firm enhanced its CAVA portfolio allocation by 81.12% over the last three months.

Capital Research Global Investors currently owns 3,789K shares, which amounts to 3.31% ownership. In its last filing, the firm reported owning 4,941K shares, showing a 30.38% decrease and a slight drop in portfolio allocation by 2.99% over the past quarter.

BlackRock holds 3,573K shares, representing 3.12% ownership of the company.

Fintel offers an in-depth investing research platform tailored to individual investors, traders, financial advisors, and small hedge funds. Our extensive data covers global fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading, options flow, and more. Our unique stock picks are driven by advanced, backtested quantitative models aimed at maximizing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.