Will Chewy Bounce Back? Analyzing the E-commerce Pet Supply Leader

The key to achieving investment success lies not in complexity, but in identifying the right stocks from promising companies within the right industries at the right times. While simple, this approach is not always easy; it requires patience and the ability to stay focused amid countless distractions.

Chewy’s Unique Approach to Pet Supplies

If you’re searching for a solid growth stock, consider Chewy (NYSE: CHWY), which has dipped 74% from its all-time high. Following a significant post-pandemic pullback, the market appears to be acknowledging Chewy’s past successes and future potential.

Even if you don’t own a pet, you likely recognize Chewy’s name, which has been a leading supplier of pet food, toys, and medications since 2011. The company now boasts an impressive valuation of $13 billion, generating around $11 billion in annual sales.

What sets Chewy apart from competitors like Petco, PetSmart, and Tractor Supply‘s Petsense is its lack of physical retail stores. Chewy operates exclusively online, a strategic move that many initially viewed as a disadvantage. However, this decision has proved to be forward-thinking as consumer shopping habits continue to evolve.

Future Growth for Chewy and the Pet Industry

Although much shopping has shifted online, many consumers still prefer to purchase pet supplies in brick-and-mortar stores, particularly due to the heavy and perishable nature of items like pet food. Yet, this trend is changing. With its growing scale and experience, Chewy is becoming more adept at meeting customer demands for convenience and competitive prices.

Predictions support this transition. According to Packaged Facts, the U.S. pet market is projected to grow 4.9% this year, reaching $152.3 billion. In contrast, the e-commerce segment is expected to grow by 12.3% in 2024, with global e-commerce in pet care projected to expand at an annualized rate of 11.4% through 2032. Bloomberg Intelligence further estimates that the U.S. online pet supply market could double by 2030, reaching a value of $60 billion.

As a leader in the online pet supply market, Chewy commands around 36% of this space, including sales through Amazon, positioning itself well to capture this anticipated growth and enhance its revenue and profitability.

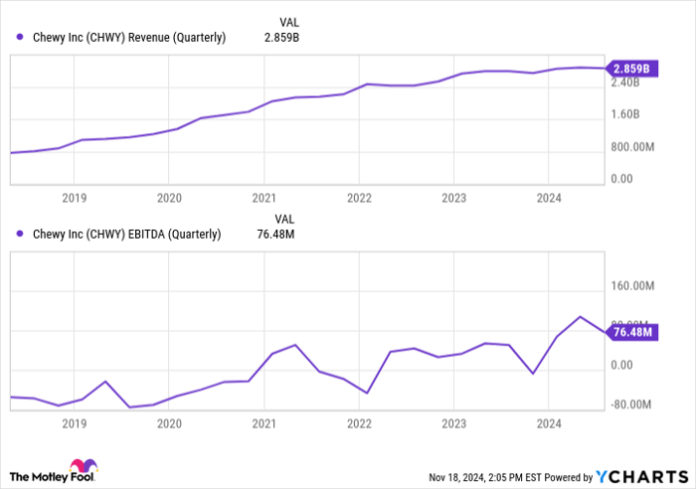

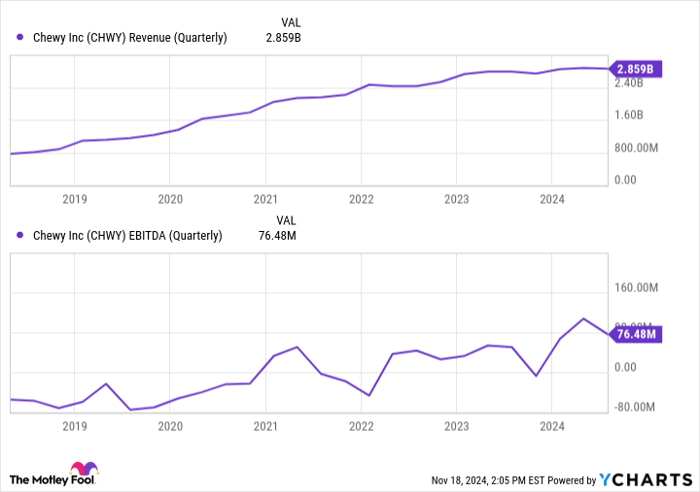

CHWY Revenue (Quarterly) data by YCharts

Understanding Chewy’s Market Challenges

The question arises: Why has Chewy’s stock price plunged 74%? The answer lies in the extraordinary yet temporary circumstances impacting many e-commerce firms. During the COVID-19 pandemic, Chewy’s stock price surged dramatically. By 2022, a reassessment showed that while Chewy has substantial growth potential, its stock had become overvalued based on the company’s performance at the time.

Despite some recovery in early 2023, investors are still possibly undervaluing the stock, considering the positive outlook and Chewy’s overall potential.

Admittedly, there are risks. Chewy is only marginally profitable, and it faces stiff competition from giants like Walmart and Amazon—companies that possess the resources to target smaller competitors aggressively. However, Chewy’s focused approach may well provide an advantage in the marketplace rather than being a hindrance.

Your Chance to Invest in Chewy

Have you ever felt you missed out on investing in a high-performing stock? Now may be a timely opportunity.

Our team of expert analysts sometimes issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. Consider these examples:

- Nvidia: if you had invested $1,000 when we doubled down in 2009, you’d have $381,173!

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,232!

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $469,895!

Currently, our analysts are issuing “Double Down” alerts for three exceptional companies. This may be a rare chance to invest before the price rises further.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, which is an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no positions in the stocks mentioned. The Motley Fool has vested interests in and recommends Amazon, Chewy, and Walmart. The Motley Fool also favors Tractor Supply. For additional information, please refer to our disclosure policy.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.