CDW Corporation Faces Challenges with Disappointing Q3 Earnings

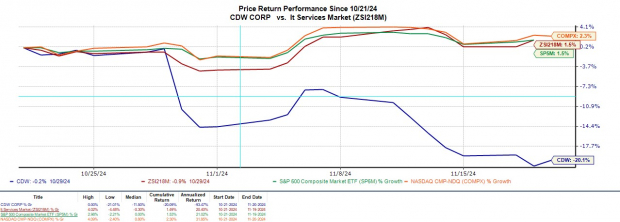

CDW Corporation CDW reported weaker-than-expected Q3 results at the end of October, which has decreased earnings estimate revisions and rattled investor confidence.

With its stock down nearly -20% this year, CDW is now assigned a Zacks Rank #5 (Strong Sell), indicating potential for further declines.

Disappointing Earnings Performance

Investors were discouraged as CDW’s Q3 earnings of $2.63 per share fell short of the Zacks EPS Consensus of $2.84 by -7%. This marked a drop from $2.72 per share reported in Q3 2022. In fact, CDW has not met earnings expectations in three out of its last four quarterly reports, averaging a -4.73% surprise in that time frame.

Image Source: Zacks Investment Research

Sales for Q3 also fell, coming in at $5.51 billion compared to $5.62 billion in the same quarter last year, and were -3% below estimates of $5.71 billion. CDW has similarly missed revenue forecasts in three of the latest four quarters, accumulating an average sales surprise of -2.67%.

Image Source: Zacks Investment Research

Market Pressures and Increased Competition

CDW cites economic uncertainty and a rapidly changing technology landscape as reasons for its disappointing results, leading to slower customer decision-making and delayed projects.

Additionally, CDW faces intensified competition, drawing attention to rivals like Accenture ACN, Dell Technologies DELL, and IBM IBM.

Falling Earnings Forecasts

Recent fiscal forecasts indicate that earnings estimates for 2024 have decreased by 5% in the last month, now expected to be $9.46 per share, down from $9.97. More troubling, estimates for FY25 have also dipped over 2% recently.

Image Source: Zacks Investment Research

Conclusion

Given the competitive pressures and current financial performance, it might be prudent to hold off on investing in CDW’s stock for the time being. Other options appear more promising within the larger scope of the Zacks Computers-IT Services Industry, which ranks in the top 19% among 250 Zacks industries.

Research Chief Identifies “Single Best Pick to Double”

Zacks experts have pinpointed five potential stocks expected to surge +100% or more in the upcoming months. Among these, Director of Research Sheraz Mian has singled out one with the highest potential for explosive gains.

This company focuses on millennial and Gen Z demographics, reporting nearly $1 billion in revenue just last quarter. A recent dip in stock price presents an attractive buying opportunity. While not all selected stocks guarantee success, this one has a chance to outperform notable previous picks like Nano-X Imaging, which soared by +129.6% in a little over nine months.

Free: See Our Top Stock And 4 Runners Up

Interested in the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double today to access this exclusive report.

CDW Corporation (CDW): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.