NVIDIA Corporation NVDA has exceeded expectations in its latest quarterly earnings report, fueled by strong demand for its artificial intelligence (AI) chips.

With solid performance in the data center segment, NVIDIA stock is currently well-priced and shows positive trends. Here’s a closer look.

NVIDIA Reports Impressive Growth in Data Center Revenues

NVIDIA reported fiscal third-quarter results with revenues soaring 94% to $35.1 billion compared to the same quarter last year. Earnings per share (EPS) reached $0.81, reflecting a remarkable 103% increase year-over-year.

The uptick in revenues surpassed Wall Street forecasts, largely due to the data center division, which generated $30.8 billion, climbing 112% from a year prior.

CEO Jensen Huang noted strong demand for its Superchips, especially the Hopper chips, and anticipates this trend to continue into next year.

The advanced H200 chips are set to be integrated into cloud services like Azure, Google Cloud, and AWS. Additionally, the Danish government has introduced an AI supercomputer powered by H100 Tensor Core graphics processing units (GPUs), underlining rising demand from both government and private sectors.

Looking ahead, Huang mentioned that demand for the anticipated next-generation Blackwell chips is “staggering” and will enhance AI capabilities significantly.

Tech giants, including Microsoft Corporation MSFT and Meta Platforms, Inc. META, are expected to adopt Blackwell chips due to their ability to improve AI performance and cost-effectiveness.

According to SoftBank Corp, NVIDIA’s Blackwell platform will contribute to Japan’s most powerful AI supercomputer, and it may also be crucial for Taiwan’s fastest AI supercomputer. This data center growth promises to bolster NVIDIA’s market position and elevate its share value, presenting a compelling investment opportunity.

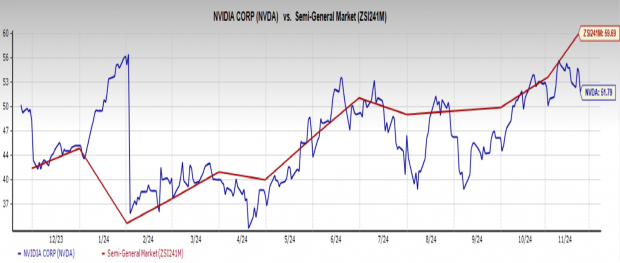

NVIDIA’s Valuation Remains Competitive

NVIDIA’s robust third-quarter results align with a history of impressive financial performances. As a leading force on the S&P 500, NVIDIA holds the title of the most valuable company in its sector.

Despite its achievements, investing in NVIDIA stock now tends to be more affordable compared to its peers. With a price-to-earnings ratio of 51.7X forward earnings, NVDA is priced lower than the Semiconductor – General industry average of 59.6X.

Image Source: Zacks Investment Research

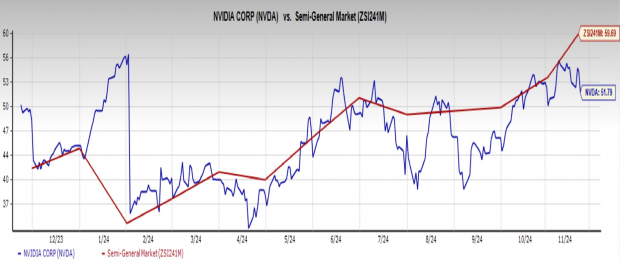

Encouraging Trends in NVIDIA’s Stock Performance

Although NVIDIA’s impressive quarterly performance initially led to a dip in share price due to excessive hype, a correction was expected. Presently, NVIDIA stock is trading above both its 50-day and 200-day moving averages, suggesting a promising bullish trend for investors.

Image Source: Zacks Investment Research

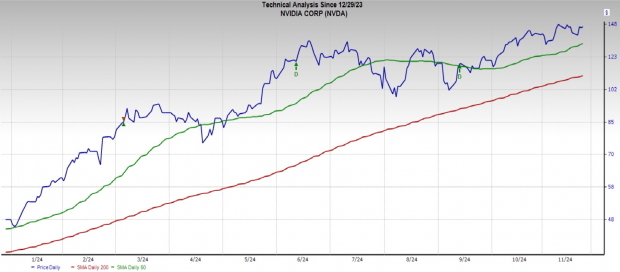

NVIDIA’s Financial Health Remains Strong

For some time, NVIDIA has effectively managed costs while consistently generating profits, solidifying its position as a top investment choice.

The company boasts a net profit margin of 55%, surpassing the industry average of 47.3%. A profit margin over 20% is typically regarded as high in the sector.

Image Source: Zacks Investment Research

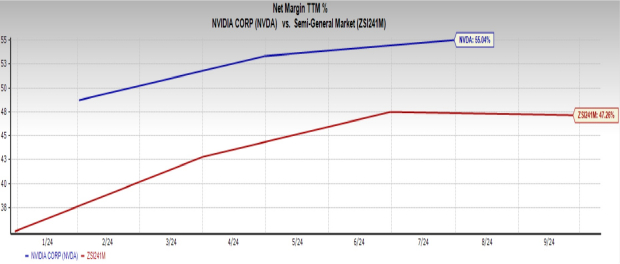

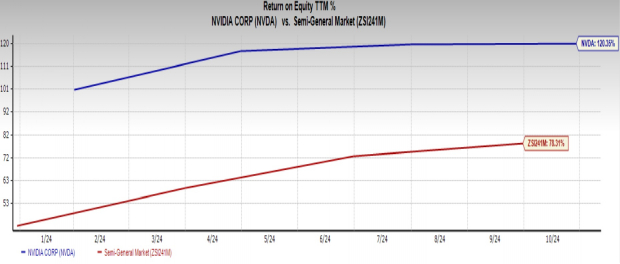

NVIDIA’s return on equity (ROE) stands at 120.4%, significantly higher than the industry average of 78.3%, indicating strong profitability relative to shareholder equity.

Image Source: Zacks Investment Research

NVIDIA’s strong metrics have earned it a Zacks Rank #1 (Strong Buy). To explore more high-performing stocks, continue reading to find out why NVIDIA is included in the Dow and why it’s a timely buy.

5 Stocks with Potential for Major Gains

Each of these was selected by a Zacks expert as the top stock with potential for +100% returns in 2024. While prior recommendations previously surged by +143.0%, +175.9%, +498.3%, and +673.0%, not all can be winners.

Many of these stocks are currently flying under the radar, creating an opportunity for early investment. Discover more about these potential success stories >>

For the latest recommendations from Zacks Investment Research, download the report on 5 Stocks Set to Double.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read more about this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.