“`html

Investing in the Future: Two AI Stocks to Consider for Your Portfolio

The rise of artificial intelligence (AI) has significantly boosted shares of tech companies over the last few years. This growing technology is anticipated to have a major impact on the global economy.

According to management consultancy firm PwC, generative AI could contribute an astounding $15.7 trillion to the global economy by 2030. This growth will largely result from increased productivity and improved consumer products. Companies are recognizing the potential and eagerly incorporating AI-focused solutions into their offerings.

It’s encouraging to see many of these companies benefiting from AI, with trends suggesting continued success as the technology is still in its developmental stages. Therefore, investing in promising AI stocks could be an intelligent choice for long-term investors. This approach allows individuals to take advantage of a transformative trend while also enjoying compounding growth in their investments.

This article reviews two AI stocks that appear promising for investors aiming to build wealth. Both companies are already seeing positive impacts from AI adoption, with potential for exceptional returns due to the lucrative sectors they serve.

1. Palantir Technologies

Software provider Palantir Technologies (NYSE: PLTR) went public just over four years ago in September 2020. Since then, the stock has surged an impressive 544% (as of this writing), with most of the gains occurring in the last year.

An investment of $1,000 in Palantir at its IPO would now be worth over $6,400. The company stands to gain even more as it taps into increasing demand for AI software platforms.

In the third quarter of 2024, Palantir’s revenue rose 30% year over year to $726 million, while adjusted earnings per share increased by 43% to $0.10. This acceleration is notable compared to the 17% growth it experienced in the same quarter a year earlier. The demand for Palantir’s Artificial Intelligence Platform (AIP) plays a critical role in this upward trend, enabling clients to integrate generative AI into their operations to enhance efficiency.

According to CEO Alex Karp, AIP has “transformed our business.” The demand for this AI platform has led to a substantial increase in both customer numbers and deal sizes. In Q3, Palantir’s customer base expanded by 39% compared to the previous year, improving on last year’s 34% growth. Additionally, the company secured 104 deals valued at $1 million or more in the last quarter, up from 80 in the same quarter last year, bolstering its revenue pipeline.

Palantir’s remaining deal value at the end of the last quarter was $4.5 billion, representing a 22% increase from the previous year. This figure indicates the total remaining value of contracts as of the reporting period’s end. Furthermore, existing customers are increasing their spending on Palantir’s offerings, reflected in a net-dollar retention rate of 118% for Q3, up from 107% the preceding year.

This retention rate is calculated by dividing the trailing-12-month revenue at the end of the quarter by the previous year’s revenue from the same customers. A rate above 100% indicates that customers are spending more on Palantir’s services. This success has led to an impressive increase in its adjusted operating margin, which rose by 11 percentage points in the first nine months of 2024 to 37%, driving notable earnings growth.

Market research from International Data Corporation (IDC) suggests that the AI software platforms market could grow from $28 billion last year to $153 billion by 2028. This indicates substantial room for Palantir’s revenue and earnings to expand in the future, making it a solid option for investors looking to build a strong portfolio.

2. Arm Holdings

The British technology firm Arm Holdings (NASDAQ: ARM) went public last September and has seen its shares more than double, achieving a remarkable 102% gain (as of this writing). However, delving deeper into Arm’s business model reveals even more growth potential.

Arm’s intellectual property (IP) is essential for chipmakers and original equipment manufacturers (OEMs) in designing their chips. The company licenses its chip designs for a fee and also collects royalties on each chip produced and sold using its technology. Arm has maintained a significant market share across various semiconductor markets.

Remarkably, 99% of smartphone application processors are based on Arm’s designs. Notably, even though the smartphone market is growing slowly, Arm’s royalty revenue from this segment surged 40% year over year in Q3 2024, greatly outpacing the mid-single-digit growth of smartphone shipments in the same period.

Management attributes this robust revenue increase to the rising adoption of its Armv9 architecture, which commands a higher royalty rate compared to previous designs. Armv9 now represents 25% of the company’s total royalty income, suggesting ample prospects for further growth.

The momentum behind Armv9 is fueled by its capabilities in addressing AI workloads, evidenced by its adoption by Apple for the chipsets in the AI-enabled iPhone 16 lineup. With demand for generative AI smartphones expected to grow annually by 78% through 2028—reaching 912 million units—it is likely that more businesses will seek Arm’s expertise in designing AI chipsets.

Arm also highlights the traction of Armv9 in the cloud computing sector. For example, Nvidia has developed its Grace AI CPU using the Armv9 instruction set, further indicating another promising avenue for Arm’s growth as demand for AI chips soars.

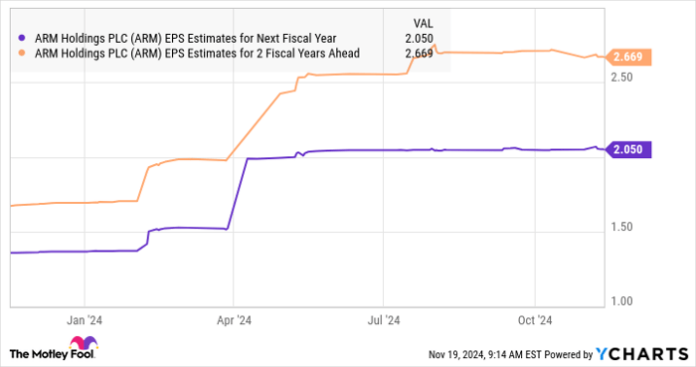

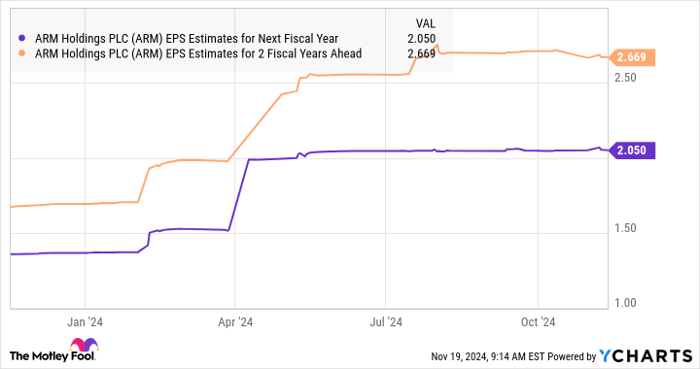

Given this context, analysts project an acceleration in Arm’s earnings growth. The company anticipates finishing the current fiscal year with earnings of $1.55 per share, a 22% increase from the previous fiscal year.

“`

Why Arm Holdings Could Be a Strong Addition to Your Portfolio

Expecting Growth and Innovation

Arm Holdings is expected to earn $1.27 per share this year, but forecasts indicate stronger growth in the coming years.

Data regarding ARM’s EPS estimates for the next fiscal year is provided by YCharts.

Like Palantir Technologies, Arm Holdings could sustain its impressive stock market performance, driven by robust AI-related earnings growth. Given Arm’s influential position in the global semiconductor market, it presents a compelling option for investors looking to diversify their portfolios, especially with a business model that offers significant stability.

Should You Invest in Palantir Technologies Today?

Before considering an investment in Palantir Technologies, here are some points to ponder:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the 10 best stocks for investors to buy right now… Palantir Technologies was not included. The selected stocks could see impressive returns in the upcoming years.

Take, for example, Nvidia. When it made this list on April 15, 2005, if you had invested $1,000 then, it would now be worth $898,809!*

Stock Advisor offers investors a straightforward roadmap for success, with guidance for creating portfolios, regular analyst updates, and two fresh stock picks each month. Since its inception in 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Harsh Chauhan owns no shares in any of the companies mentioned. The Motley Fool has investments in and recommends Apple, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.