Exploring High-Yield Stocks Amidst Oil Market Volatility

The Oil/Energy market is experiencing significant fluctuations, with prices recently falling below $70 per barrel. Various factors contribute to the downturn, including concerns about weaker global demand, an underwhelming Chinese economic stimulus, and a strengthening U.S. dollar. As of Thursday, Brent crude closed at $74.23 a barrel, while WTI ended the day at $70.10, both showing a decline year-to-date. Analysts caution that upcoming production increases from OPEC+ could push prices down further despite ongoing geopolitical tensions.

Safe Havens: High-Yield Large-Cap Stocks

During periods of oil market instability, high-yield large-cap stocks — companies valued at over $10 billion — offer a safe place for investors looking for steady returns. These stocks typically provide attractive dividends, which can help counteract the volatility of commodity prices. Their strong cash flow and historical reliability make them appealing for creating more balanced investment portfolios.

Canadian Natural Resources Limited (CNQ), Chevron (CVX), and Kinder Morgan (KMI) are among the top choices for investors seeking stability in the energy sector.

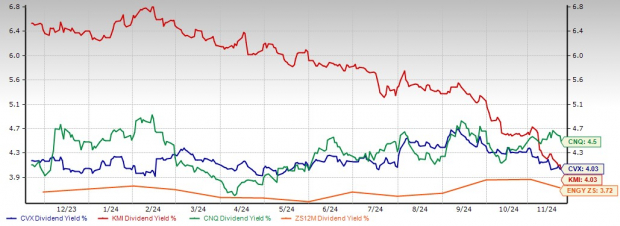

Dividend Yields of CNQ, CVX, and KMI

Image Source: Zacks Investment Research

The Importance of Size in Investing

These large-cap companies are financially solid, well-respected, and extensively analyzed. Their consistent dividend payments create added appeal for income-focused investors seeking lower risks. While they may not promise the rapid growth potential of smaller firms, large-cap stocks like these tend to offer more stability in terms of price, making them a sensible choice for cautious investors.

Highlighting Our Top Picks

Canadian Natural Resources: One of Canada’s largest independent energy firms, Canadian Natural Resources is deeply involved in oil and natural gas exploration, development, and production. The company has a diverse portfolio that includes heavy and light crude oil, natural gas, bitumen, and synthetic crude oil.

Headquartered in Calgary, CNQ has surpassed Zacks Consensus Estimates in three of the last four quarters, with an average earnings surprise of 3.9%. The company boasts a market capitalization of approximately $71.3 billion.

Investors appreciate the quarterly dividend of 56.25 Canadian cents, resulting in an annual yield of 4.5%, significantly higher than the Zacks Oil/Energy sector average of 3.7%. In a show of commitment to shareholders, CNQ recently increased its dividend by 7%.

Chevron: Based in San Ramon, California, Chevron ranks among the largest publicly traded oil and gas companies globally, engaging in all energy-related activities, from production to refining and marketing.

Chevron has exceeded Zacks Consensus Estimates for earnings in three out of the previous four quarters and holds a market capitalization of around $289.9 billion.

To view the latest EPS estimates and surprises, check out Zacks Earnings Calendar.

Chevron offers a quarterly dividend of $1.63 per share, providing a yield of 4%, outperforming the sector average and the S&P 500’s 1.2% yield.

Kinder Morgan: Headquartered in Houston, Texas, Kinder Morgan stands as a leading midstream energy infrastructure provider in North America, managing a pipeline network spanning 83,000 miles for a variety of products, including natural gas and refined oil.

Kinder Morgan, also holding a Zacks Rank of 3, has an estimated market value of approximately $62.2 billion. Analysts forecast a healthy 9.4% year-over-year growth in earnings per share for 2024.

The company pays a quarterly dividend of 28.75 cents, resulting in a yield of 4% based on current stock prices.

Investing Opportunities Ahead

Each stock discussed has been selected by Zacks experts, highlighting their potential for significant growth in 2024. Past recommendations have yielded impressive gains, but it is essential to conduct thorough research.

For investors looking to maximize returns, considering lesser-known stocks could present ample opportunities for growth.

Discover These 5 Stocks Expected to Double >>

Chevron Corporation (CVX): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Kinder Morgan, Inc. (KMI): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.