“`html

Walmart’s Growth Surges as E-Commerce Expands

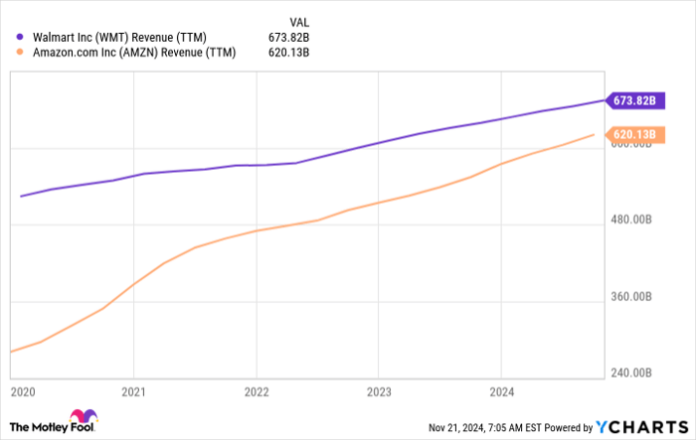

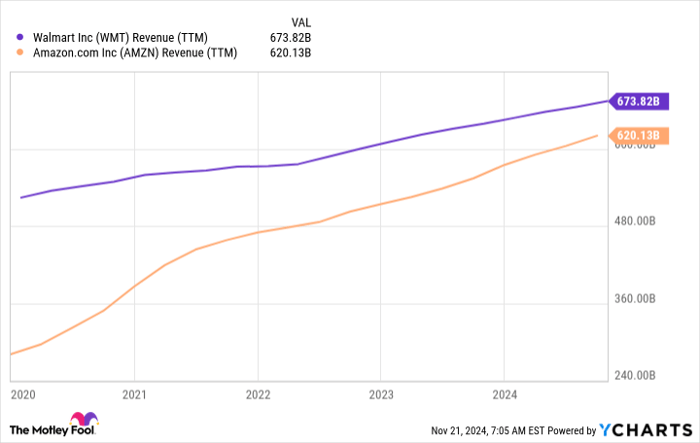

Walmart (NYSE: WMT) remains the leading retailer in the U.S. by sales and continues to see impressive growth. For some time, it seemed rival Amazon (NASDAQ: AMZN) might take the lead, but Walmart’s size and performance keep it firmly in the top spot. Both giants boast revenues exceeding $600 billion over the past year.

Last week, Walmart released another strong quarterly report, highlighting two surprising growth factors: its e-commerce sector and its success in attracting higher-income customers. Historically, these have not been core strengths for the company. Nevertheless, Walmart is making strategic enhancements in its online business, which is gaining momentum. Could this change the dynamics of online retail competition with Amazon?

Walmart’s E-Commerce Journey

Walmart was slow to join the e-commerce boom, which allowed other companies to take the lead. As the largest retailer in the U.S., it had the potential for dominance. However, in recent years, Walmart has steadily built its online presence. By the time the pandemic hit, forcing many consumers to shop online, Walmart was better equipped than before, even if it still trails Amazon.

In the fiscal third quarter of 2025, which ended on October 31, total sales rose by 5.5% compared to last year, while e-commerce sales surged by 27%. U.S. sales grew by 5.3%, with e-commerce sales climbing 22%. Several key reasons for this growth included in-store order fulfillment, in-store pickup, advertising, and marketplace presence.

Walmart’s international sales revealed an impressive 43% increase in e-commerce revenue year-over-year, aided primarily by available order fulfillment and pickup options. Additionally, e-commerce sales for Walmart’s Sam’s Club, a membership-based warehouse chain, grew by 26%, largely attributed to in-store services.

Management indicated that their growing appeal to higher-income customers has played a significant role in this performance. This demographic made up 75% of Walmart’s market share gains in the most recent quarter.

Currently, Walmart’s e-commerce business has yet to achieve profitability, but the company possesses the resources to scale it until it does. Management is optimistic about reaching that milestone.

Competing with Amazon

Interestingly, Walmart’s e-commerce growth may be faster than that of Amazon. In the third quarter, Amazon’s net sales from online stores grew by 7%, with revenues from third-party sellers up by 10% and advertising revenues rising 19%.

However, Walmart is unlikely to surpass Amazon in online sales immediately. Last year’s Statista report stated that Amazon accounted for 37.6% of U.S. e-commerce sales, while Walmart only held 6.4%. Yet Walmart’s increasing market share represents a significant dollar amount.

Walmart benefits from a network of over 4,600 stores across the U.S., providing advantages that Amazon lacks, such as in-store pickup and other omnichannel experiences. While these factors may not completely offset Amazon’s logistical superiority or its Prime membership benefits, they ensure that Walmart retains a share of e-commerce sales among customers who prefer the advantages offered by physical locations.

Despite conversations suggesting Amazon might soon eclipse Walmart, the gap appears to be closing more slowly than expected, especially as Amazon’s growth in non-e-commerce sectors continues. With its robust e-commerce operations maturing, Walmart seems poised to maintain its standing against Amazon for a longer period.

WMT Revenue (TTM) data by YCharts

Is Walmart Stock Worth Buying?

Walmart’s remarkable performance recently contrasts sharply with that of its competitor, Target, which has experienced a different trajectory during the same timeframe. Its e-commerce division is reported to be growing faster than that of Amazon, Target, and Costco.

Despite Walmart stock appearing more attractive now, it isn’t considered a bargain. It currently trades at a P/E ratio of 36, which exceeds its five-year average of 31. Thus, this might not be the best time to purchase shares. However, investing in Walmart represents a long-term strategy, bolstered by its consistently growing dividends. This resilient stock has performed well this year, rising 67%, outpacing many growth stocks. One could invest at various times and still expect steady returns over time.

Should You Invest $1,000 in Walmart Right Now?

Before considering a stock purchase in Walmart, reflect on this:

The Motley Fool Stock Advisor analysts recently identified what they believe to be the 10 best stocks for current investment opportunities, and Walmart did not make the list. Those 10 selections could yield considerable returns in the next few years.

Consider how Nvidia was featured in this list back in April 15, 2005… had you invested $1,000 at the time of our suggestion, it would be worth $869,885!*

Stock Advisor provides a straightforward road map for investors, complete with guidance on portfolio building, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market and an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil does not hold any positions in the stocks mentioned. The Motley Fool holds positions in and recommends Amazon, Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`