Maximize Your Returns: A Closer Look at the Vanguard S&P 500 Growth ETF

Investing in growth stocks offers a solid way to enhance your portfolio. However, choosing the right stocks can be challenging. Previously, metaverse stocks captured Wall Street’s attention, but now the focus has shifted to artificial intelligence stocks and GLP-1 weight loss stocks, which show significant long-term potential.

With numerous options available, selecting the best growth stocks can feel overwhelming. Exchange-traded funds (ETFs) can simplify this process; when you invest in an ETF, you’re essentially investing in a collection of stocks included in the fund. Your challenge lies in finding the ETF that aligns with your investment objectives.

Spotlighting a Top Choice: Vanguard S&P 500 Growth ETF (VOOG)

The Vanguard S&P 500 Growth Index Fund ETF Shares (NYSEMKT: VOOG) is a strong candidate for long-term investors aiming for a retirement goal of $1 million. This ETF focuses exclusively on growth companies within the S&P 500, providing exposure to blue-chip stocks with significant long-term growth potential.

Leading this fund are major players like Apple, Nvidia, and Microsoft, which together represent over 35% of the fund’s total assets. Notably, Eli Lilly, a leading weight loss and GLP-1 drug company, ranks among the top ten holdings. The technology sector dominates the fund, constituting nearly half of its portfolio.

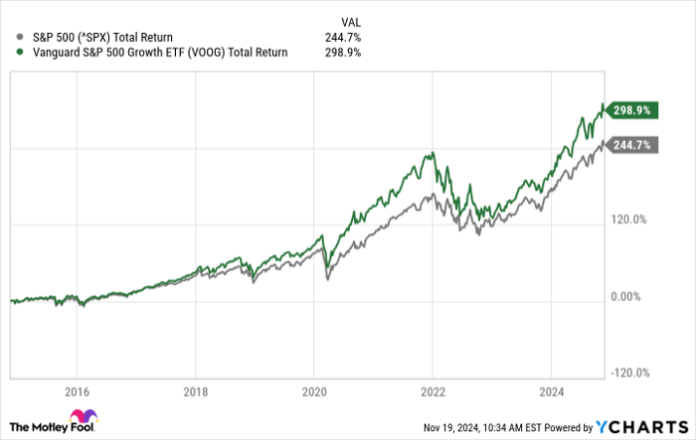

Investors will appreciate the fund’s low expense ratio of 0.1%, making it a cost-effective choice for those looking to maximize returns over time. Over the last decade, this ETF has delivered exceptional performance, achieving total returns—including dividends—of approximately 300%, which translates to a compounded annual growth rate of 14.9%.

^SPX data by YCharts.

How Much You Need to Invest for a $1 Million Goal

Given the ETF’s strong historical performance averaging around 15% per year, it is wise to adopt a conservative outlook for future returns. Assuming an 8% annual growth rate, the following table illustrates what various initial investments could grow to over time.

| Investment | 30 Years | 35 Years |

|---|---|---|

| $25,000 | $251,566 | $369,634 |

| $30,000 | $301,880 | $443,560 |

| $35,000 | $352,193 | $517,487 |

| $40,000 | $402,506 | $591,414 |

| $45,000 | $452,820 | $665,340 |

| $50,000 | $503,133 | $739,267 |

| $55,000 | $553,446 | $813,194 |

| $60,000 | $603,759 | $887,121 |

| $65,000 | $654,073 | $961,047 |

| $70,000 | $704,386 | $1,034,974 |

| $75,000 | $754,699 | $1,108,901 |

Calculations by author.

To reach the $1 million target with these projections, you would need to invest at least $70,000 today and remain patient for 35 years. However, these are conservative estimates. If the ETF outperforms, even a slight improvement could yield better results. For instance, a 9% annual return would allow a $50,000 investment to grow to $1 million over 35 years.

Long-Term Investment Strategy: Steady and True

While predicting specific returns over long periods remains difficult, investing in a growth-oriented fund like Vanguard’s ETF can significantly increase your portfolio’s value. A disciplined approach of buying and holding can offer excellent opportunities for growth over the years.

Seize Your Second Chance at Top Investments

Have you ever felt like you missed the opportunity to invest in successful stocks? You might want to pay attention now.

Our expert analysts occasionally identify companies ripe for growth, dubbed as “Double Down” stocks. If you think you’ve passed up your chance to invest, you could be at a pivotal moment now. Just look at the potential gains:

- Nvidia: If you invested $1,000 in 2009, you’d have $368,053!*

- Apple: If you invested $1,000 in 2008, you’d have $43,533!*

- Netflix: If you invested $1,000 in 2004, you’d have $484,170!*

At present, we are issuing “Double Down” alerts for three promising companies; this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.