SoFi Technologies: Is This Fintech Disruptor Your Ticket to Wealth?

SoFi Technologies(NASDAQ: SOFI) has become a remarkable success story, boasting a staggering 240% rise in its stock price since the start of 2023. After reinventing itself over the past few years, the company celebrated its first profitable quarter last year and has maintained profitability for four consecutive quarters now.

As SoFi’s earnings improve and it continues to attract new customers, many investors wonder: Could investing in SoFi stock today lead to millionaire status? Let’s explore its potential for the future.

SoFi’s Journey of Transformation

SoFi has shown remarkable growth since its inception in 2011. The company began as a platform for refinancing student loans. However, the COVID-19 pandemic in 2020 forced significant changes when the government introduced a pause on these loans.

In 2020, SoFi issued $2.6 billion in personal loans, a shift from the $4.9 billion in student loans during the same period. Adapting to market needs, it dramatically increased personal loan originations to $13.8 billion by 2023, a 430% rise, while its student loan volume dropped to $2.6 billion.

A major turning point for SoFi was its acquisition of Golden Pacific Bancorp for $22 million in 2022. This move allowed SoFi to transform from merely a lending platform into a comprehensive financial services provider. With its bank charter, SoFi can now fully offer banking products, including checking and savings accounts, as well as credit and debit cards, investment accounts, and cutting-edge technology solutions.

The advantages of having a bank charter are notable. SoFi can now collect deposits, creating a stable base for funding its loans. Additionally, it has the flexibility to hold loans on its balance sheet, capitalizing on higher net interest income—an aspect that has become increasingly evident as interest rates have risen.

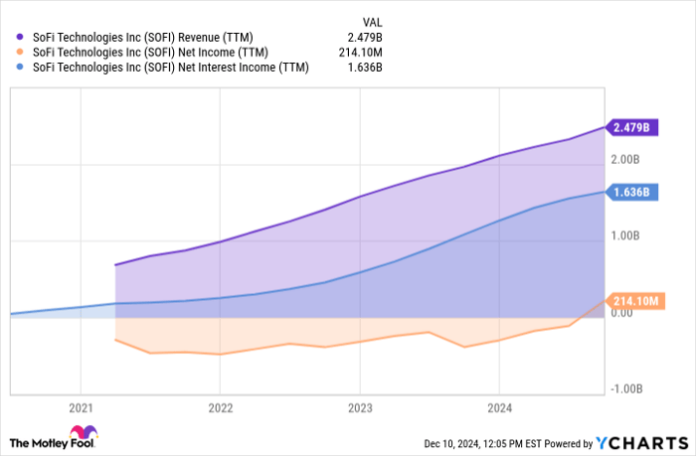

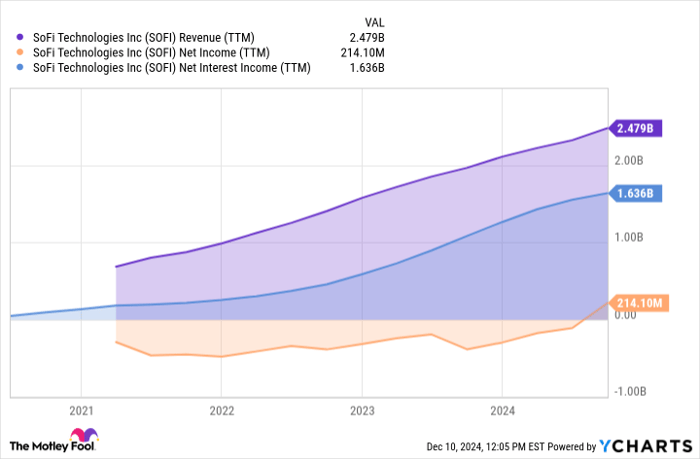

Last year, SoFi achieved $1.3 billion in net interest income, marking a 116% increase from the previous year. So far this year, through three quarters, its net interest income is $1.2 billion—up 43% compared to the same timeframe last year.

SOFI Revenue (TTM) data by YCharts

Innovating Through Technology

While SoFi is making strides in the banking sector, its unique technology platform sets it apart from competitors. Recent investments in Galileo and Technisys have strengthened SoFi’s technological framework, allowing it to provide banking services not only to its users but also to non-bank companies.

Galileo acts as a critical backend solution for fintechs without banking charters, facilitating payments and various banking services through SoFi. Meanwhile, Technisys modernizes archaic banking systems, offering a platform that supports multiple products and real-time data processing in the cloud.

SoFi’s vision is to become the Amazon Web Services (AWS) of fintech, bolstering its business model through long-term contracts with clients. In the first three quarters of this year, the technology segment brought in $263 million in net revenue, an 11% increase from last year.

Looking Ahead: What’s Next for SoFi?

SoFi anticipates strong growth in 2024, projecting adjusted net revenue to hit $2.5 billion, signaling a 23% increase year-on-year. This projection exceeds the company’s original estimate of 16% growth.

A significant development for SoFi was its announcement on Oct. 14, regarding a $2 billion agreement for a personal loans platform in collaboration with funds managed by Fortress Investment Group. This strategic move aims to diversify SoFi’s revenue streams toward less capital-intensive and more fee-based sources, according to CEO Anthony Noto.

This shift could also reflect improving investor sentiment, indicating growing confidence in the quality of SoFi’s loans amidst earlier concerns regarding rising charge-offs.

Can SoFi Make You a Millionaire?

If you had invested $10,000 at the beginning of 2023, that investment would now be worth around $33,770. To turn that into $1 million, SoFi would need to achieve an annual return of 40% over the next ten years.

A larger investment could potentially reach a million-dollar value, but it’s crucial to understand the risks involved. Relying heavily on a single stock for significant gains is risky, as market conditions can change.

What truly matters is adopting a saving habit and gradually building your investment portfolio over time. Maintaining a long-term perspective and developing a diverse portfolio with various investment types should be the goal, with SoFi constituting just a part of that strategy.

Is Now the Right Time to Invest in SoFi Technologies?

If you are considering purchasing stock in SoFi Technologies, remember a key point:

The Motley Fool Stock Advisor team recently identified their choice of what they believe are the 10 best stocks to buy right now—and SoFi Technologies is not among them. The selected stocks could deliver impressive returns in the coming years.

For context: When Nvidia was recommended on April 15, 2005, an investment of $1,000 would be worth $853,765 today.!*

Stock Advisor offers an easy-to-follow plan for investors, including portfolio-building assistance, regular analyst updates, and two new stock picks each month. Since 2002, the service has more than quadrupled the S&P 500’s returns.*

View the 10 stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.