Analysts Predict Upsides for Innovator Equity Managed Floor ETF and Its Key Holdings

The Innovator Equity Managed Floor ETF (Symbol: SFLR) shows a promising outlook as analysts estimate an average target price of $36.72 per unit for the ETF based on its underlying assets. This is in contrast to its recent trading price of $33.51 per unit, indicating a potential upside of 9.58%.

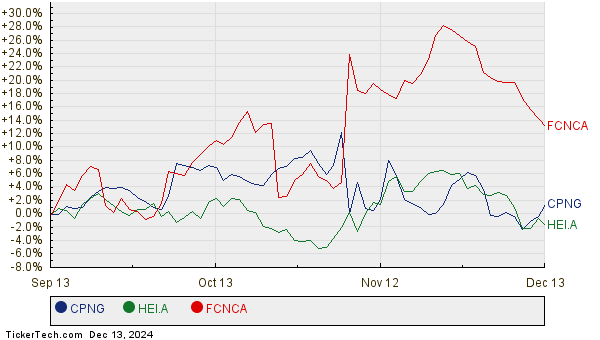

Among SFLR’s key holdings, notable stocks with significant anticipated growth include Coupang Inc (Symbol: CPNG), HEICO Corp (Symbol: HEI.A), and First Citizens BancShares Inc (Symbol: FCNCA). To illustrate, CPNG trades at $24.32 per share, yet analysts aim higher with a target of $29.00 per share, reflecting a 19.24% upside. For HEI.A, the expected upside is 15.61%, with a current share price of $198.94 and a target of $230.00. Similarly, FCNCA is projected to rise from $2074.88 to $2336.54, or 12.61% above its recent trading price.

To provide a clearer picture, the following chart displays the twelve-month price trends for CPNG, HEI.A, and FCNCA:

Here’s a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Innovator Equity Managed Floor ETF | SFLR | $33.51 | $36.72 | 9.58% |

| Coupang Inc | CPNG | $24.32 | $29.00 | 19.24% |

| HEICO Corp | HEI.A | $198.94 | $230.00 | 15.61% |

| First Citizens BancShares Inc | FCNCA | $2074.88 | $2336.54 | 12.61% |

As we assess these analyst projections, one must consider whether they are well-founded or overly optimistic about the future performance of these stocks. Analysts aim to provide insights based on their evaluations, yet historical tracking is essential as market conditions can shift. High price targets may reflect a bullish outlook but can also lead to downgrades if expectations are not met. Further research by investors could be necessary to navigate these complexities.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

ETFs Holding IVZ

Funds Holding SYLD

MATW shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.