Celsius Holdings: A Turning Point After a Major Setback

Celsius Holdings (NASDAQ: CELH) suffered a staggering 70% decline in its stock earlier this year. The company’s impressive revenue growth took a downturn when a major distributor, believed to be PepsiCo, sharply reduced its orders.

However, this drop could be viewed as a strategic adjustment by the distributor. With a reasonable market valuation and significant untapped regions, a 10-fold increase in Celsius’ stock is a plausible scenario. Here’s an exploration of these factors.

Celsius: Present-Day Overview

Under the guidance of CEO John Fieldly, Celsius has made remarkable strides. The company promotes itself as a “better-for-you, zero-sugar alternative” to traditional energy drinks, effectively capturing the attention of health-conscious consumers, particularly fitness fans.

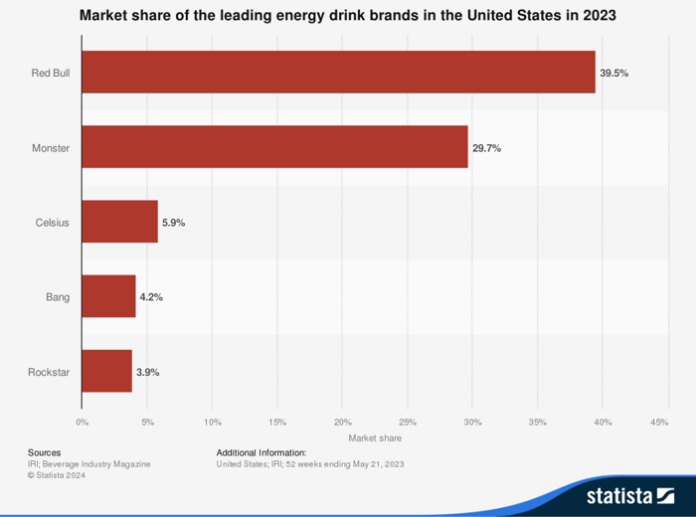

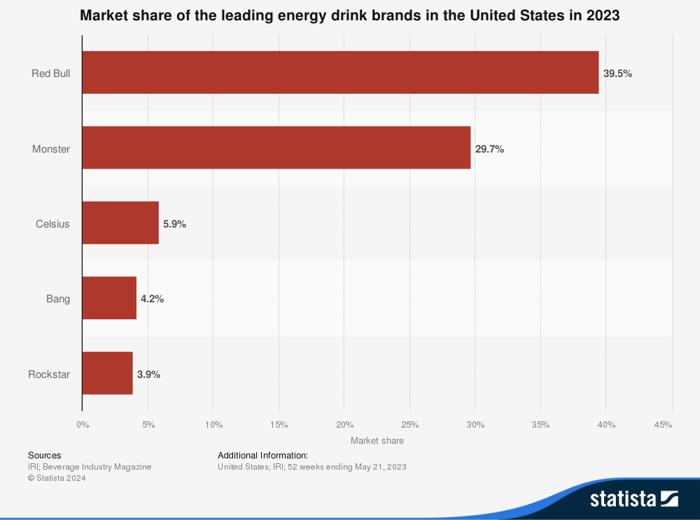

A pivotal moment came in 2022 when Celsius entered into a distribution agreement with PepsiCo, which significantly boosted sales. As a result, Celsius has ascended to become the third most popular energy drink in the United States, following Red Bull and Monster Beverage.

Data source: Statista.

Key Factors for Potential Stock Growth

While capturing market share from Red Bull and Monster isn’t enough alone for a tenfold stock increase, investors should consider these two significant aspects.

First, examine Celsius’ current valuation. The company’s P/E ratio of 39 has seen fluctuations but reflects its price-to-sales (P/S) ratio of 5. Historically, Celsius has traded at an average of 15 times sales over the past five years. This suggests a potential for tripling the stock’s value if it returns to that level.

Investors should also focus on Celsius’ largely untapped international markets. CEO Fieldly is actively pursuing expansion into the Asia-Pacific region and Europe, which could contribute significantly to future revenue.

The financial figures reinforce the need for this expansion. In the first nine months of 2024, Celsius generated $1 billion in sales, marking only a 5% annual increase. This contrasts sharply with the impressive 104% growth recorded in the same period the previous year and includes a noteworthy 31% decrease in Q3.

While the U.S. and Canada account for less than 5% of the global population, these countries made up 95% of Celsius’ sales volume during the year’s first nine months. On a brighter note, sales outside North America surged by 36%, indicating strong potential for future growth internationally.

Shifting some focus away from North America could yield massive revenue boosts for Celsius. If the company can drive international sales, reducing North America’s contribution to under 50% of overall sales could lead to substantial growth in revenue and stock valuation.

Why Now is a Good Time to Buy Celsius Stock

Investors might view the recent decline in Celsius stock as an opportunity with the potential for returns exceeding tenfold.

The 70% drop in stock price might be an overreaction, as the distributor is expected to adjust its inventory practices moving forward. The dramatic reduction in orders is likely not a long-term trend.

Additionally, Celsius is only beginning to tap into the vast majority of the global marketplace outside North America. Should it gain strong traction in Europe or Asia, the company—and the subsequent stock—could experience remarkable growth in the years ahead.

Considering a $1,000 Investment in Celsius?

Before purchasing stock in Celsius, it’s wise to consider this:

The Motley Fool Stock Advisor analyst team has highlighted what they believe are the 10 best stocks for investors at present—and Celsius did not make this list. These selected stocks show the potential for impressive returns in the upcoming years.

Take Nvidia, for instance—when it appeared on this list on April 15, 2005, a $1,000 investment at that time would now be worth $841,692!*

Stock Advisor offers easy-to-follow strategies for investor success, including portfolio building tips and consistent analyst updates with two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Will Healy holds positions in Celsius, while The Motley Fool has stakes in and recommends Celsius and Monster Beverage. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.