Could Palantir Technologies Be the Next Nvidia in the AI Race?

Investors are eagerly searching for the next big stock like Nvidia (NASDAQ: NVDA), which has surged over 2,500% in the last five years. Nvidia has reaped tremendous rewards from the AI boom, making it one of the largest companies globally.

Recently, I noted a discussion on a stock message board where investors were curious about which stock might replicate Nvidia’s success. The consensus pointed to Palantir (NASDAQ: PLTR), which has had a strong 2024, marking itself as one of the top performers on Wall Street this year.

To explore Palantir’s potential as the next Nvidia, we first need to understand what would define such a status. Five years ago, Nvidia traded at a split-adjusted price of about $5.30 (as of December 6, 2019), and it currently stands at approximately $138, translating to a gain of around 26 times. Today, Nvidia’s market capitalization is about $3.5 trillion.

In comparison, Palantir closed 2022 at $6.42 and was valued at roughly $72 as of December 11. To match Nvidia’s percentage gains, Palantir would need to rise to about $165, representing another 130% increase.

Alternatively, if we view the next Nvidia as a company worth $3.4 trillion, Palantir’s stock would need to increase twentyfold. Investors are particularly interested in finding a stock with returns similar to Nvidia’s over the next five years. Thus, we will consider if Palantir can evolve into one of the world’s largest companies during this period.

Interestingly, Palantir’s current market cap of $165 billion surpasses Nvidia’s market cap of $144 billion at the end of 2019.

Palantir Requires Significant Revenue Growth to Rival Nvidia

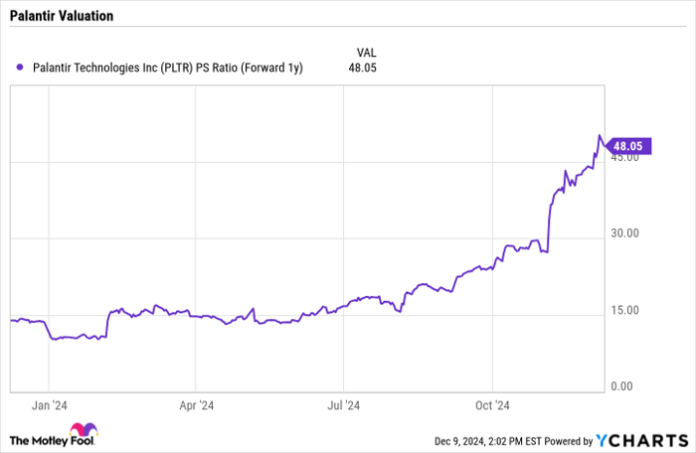

Palantir is currently valued at a steep forward price-to-sales (P/S) ratio of about 48 times the expected sales for next year. Notably, this comes after the company reported a 30% revenue growth last quarter.

PLTR PS Ratio (Forward 1y) data by YCharts

This valuation may not be justified based on current growth rates, causing some investors to speculate if Palantir’s growth could skyrocket in the coming years. After minimal growth last fiscal year, Nvidia achieved rapid revenue growth—123% in fiscal 2024 and 135% in the nine months that followed. Palantir will face a challenge as its projected 2024 sales of around $2.8 billion are significantly lower than Nvidia’s 2019 sales of $10.9 billion.

Image source: Getty Images.

Palantir’s Potential in the Competitive AI Landscape

Palantir gained initial recognition from the U.S. government, providing its innovative data analysis tools for combating terrorism. Its technology also proved valuable to the Centers for Disease Control and Prevention during the COVID-19 pandemic.

After a period of slowed growth, the company has seen a surge in demand for its new Artificial Intelligence Platform (AIP), especially in the commercial sector. Last quarter, Palantir’s U.S. commercial customers grew by 77% year-over-year, while its U.S. commercial revenue jumped 54% to $179 million. This progress is attributed to strong AI demand.

Government revenue, which slowed last year, has also rebounded, with a 40% increase last quarter as more government sectors adopt large language models (LLMs). Palantir’s revenue growth in government sectors was only 14% last year, a drop from 19% in 2022.

Importantly, Palantir does not aim to produce the best LLM but believes success in AI lies in application and workflow, where its technology excels. Its ontology integrates various digital assets with real-world counterparts, facilitating its AIP to address diverse industry needs.

This capacity to deploy AI in practical environments while minimizing errors presents a compelling opportunity for Palantir to rival Nvidia. While the company’s rapid revenue growth makes headlines, a significant portion of this growth stems from prototype work, emphasizing the need to transition these prototypes into scalable solutions. With a net dollar retention rate of 118%, Palantir is already seeing effective growth within its existing customer base.

Long-Term Prospects for Palantir in the AI Economy

Growing its customer base and streamlining these relationships into production will be essential for Palantir’s long-term revenue growth. If it successfully combines superior applications and workflows, it could achieve recognition as a leading AI software provider, similar to how Nvidia dominates the hardware space.

However, the expectations of continued growth might already be factored into the current stock price, rendering it a speculative investment at present. To reach Nvidia-like success, Palantir would need to double its revenue each year for the next five years while maintaining a P/S ratio of 40, a challenging task ahead.

Should You Invest $1,000 in Palantir Technologies Now?

Before making an investment in Palantir Technologies, consider that:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks for investors today, and Palantir Technologies is not on that list. These selected stocks hold the potential for substantial returns in the years to come.

Reflecting on when Nvidia made this list on April 15, 2005, an investment of $1,000 at that time would now be worth $822,755!*

Stock Advisor offers a straightforward roadmap for success, including portfolio guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than four times.*

Check out the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.