“`html

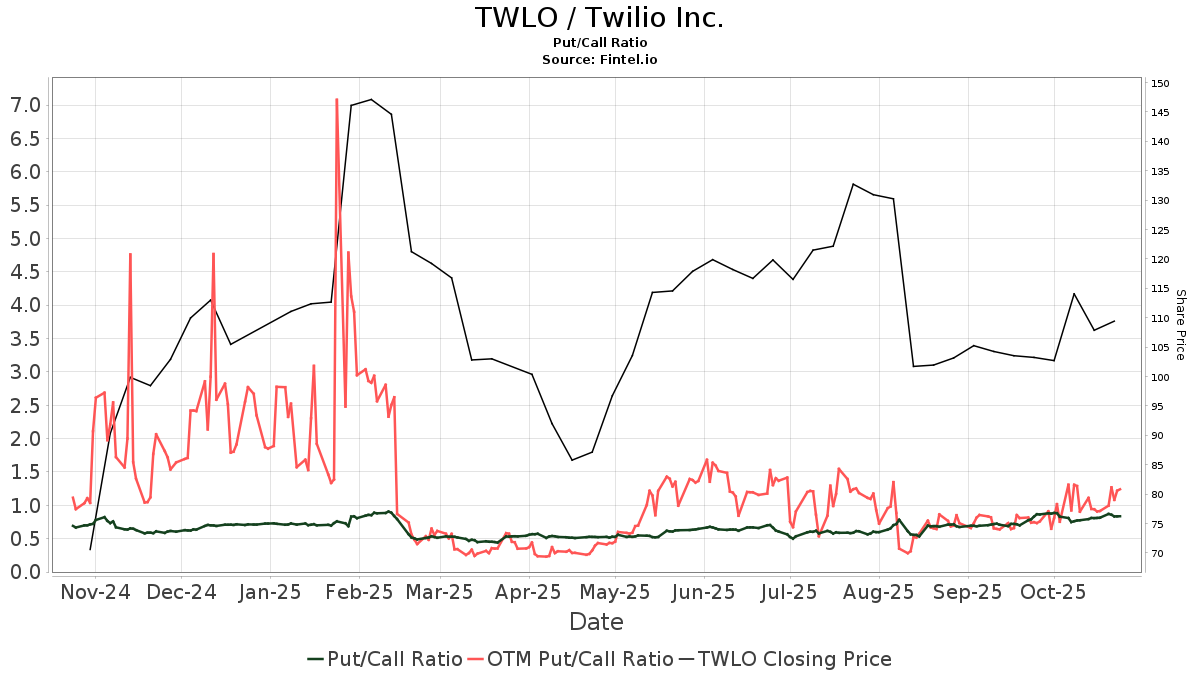

Mizuho has maintained an Outperform rating for Twilio (NYSE:TWLO) as of October 31, 2025. The average one-year price target for Twilio is $132.35/share, indicating a potential decrease of 1.91% from the last closing price of $134.93/share.

Projected annual revenue for Twilio is expected to reach $5.972 billion, a 21.97% increase, with projected annual non-GAAP EPS of 1.74. Institutional ownership has increased, with 1,388 funds reporting positions in Twilio, up by 36 (2.66%) from the last quarter, leading to a total of 149,745K shares owned.

JP Morgan Chase has increased its holdings in Twilio by 21.31% to 12,162K shares, representing 7.93% ownership. Vanguard Total Stock Market Index Fund holds 4,423K shares, a 2.15% increase, while the Vanguard Small-Cap Index Fund has decreased its holdings by 1.89% to 3,364K shares.

“`