“`html

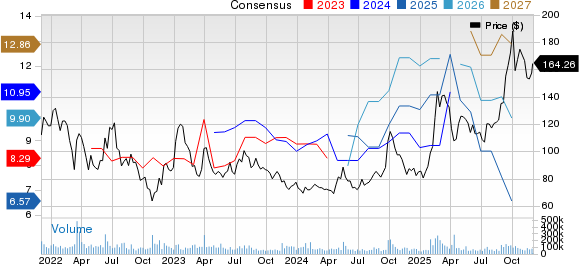

Nvidia’s Surge in Sales

Nvidia (NASDAQ: NVDA) reported an impressive 62% increase in overall sales year-over-year for the third fiscal quarter of 2026, reaching $57 billion. Notably, the data center segment contributed $51.2 billion, marking a 66% year-over-year increase and a 25% sequential rise from Q2.

CEO Insights and Market Position

CEO Jensen Huang emphasized the growth potential in AI, stating, “Compute demand keeps accelerating and compounding across training and inference,” signaling a robust market outlook. Despite concerns about competition from Google’s TPUs, Nvidia maintains that its GPUs are essential for flexible AI model training, with Huang asserting, “Nvidia is a generation ahead of the industry.”

Investor Considerations

Following the recent sales surge, Nvidia’s stock is currently trading about 13% below its recent highs. Investors may view this as an opportunity to buy into Nvidia, as fears of an AI bubble appear to be overstated, supported by strong demand in the data center market.

“`