“`html

Rubrik Inc. (RBRK) will release its third-quarter fiscal 2026 results on December 4, 2026. The company anticipates revenues between $319 million and $321 million, which represents a year-over-year growth of 35% to 36%. The Zacks Consensus Estimate is set at $320.93 million, reflecting a 35.88% increase from the previous year. The expected loss per share is 17 cents, compared to a reported loss of 21 cents per share in Q3 of the prior year.

In the second quarter of fiscal 2026, Rubrik had a 27% year-over-year increase in customers with over $100K in annual recurring revenue (ARR), reaching 2,505 customers. Furthermore, its cloud ARR grew by 57% to $1.1 billion. The company expects a non-GAAP subscription ARR contribution margin of approximately 6.5% for the upcoming quarter.

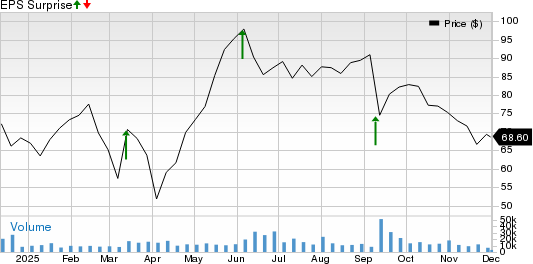

Despite these positive indicators, Rubrik’s shares have decreased by 30.1% in the past six months, underperforming the broader Zacks Computer and Technology sector which returned 27.8% during the same period.

“`