Spotlighting E-Commerce Giants: Amazon vs. Shopify

Amazon (NASDAQ: AMZN) and Shopify (NYSE: SHOP) have both been standout performers for investors, significantly outpacing the S&P 500 in returns over the last decade. With the growing e-commerce market driving their success, each company pursues unique strategies for growth.

Amazon has streamlined the e-commerce experience, while Shopify positions itself as a top software solution for third-party brands.

As we approach the end of 2024, investors are questioning which stock offers the best opportunity. Let’s delve into these two e-commerce leaders.

Shopify: Sharpening Focus on Core Strengths

The COVID-19 pandemic propelled Shopify’s growth, leading to a remarkable 100% year-over-year revenue increase in 2020 that sent its stock soaring.

However, as the company expanded into various areas such as logistics, robotics, and cryptocurrencies, it realized that it was straying from its main competencies. Competing with established logistics leaders like UPS and FedEx proved costly and challenging.

In response, Shopify refocused on its software and payment services, significantly bolstering its profitability. Recently, the company reported a 26% year-over-year revenue increase, totaling over $2 billion, along with a 19% free cash flow margin, a sharp turnaround from negative margins just two years ago.

While it’s unlikely that Shopify will maintain its 26% growth indefinitely, the company seems to have stabilized its operations and is well-positioned for continued success in the booming e-commerce space.

Amazon: Efficiency Leading to Higher Profits

Many merchants express concerns about selling on Amazon, citing issues like excessive sponsored listings and competition. Nonetheless, they frequently return to the platform due to Amazon’s unmatched logistics network and extensive customer base.

Last quarter, Amazon recorded a 9% increase in North American retail sales, totaling $95.5 billion, with international sales growing even faster at 12% year over year.

Advertising revenue, which boasts higher margins than most other segments, accelerated by 19% during the same period. Despite newer players like Shopify entering the field, Amazon retains a substantial 40% market share in the U.S. e-commerce sector.

In recent months, Amazon has focused on cost efficiency, driving its operating margin close to 10% with a free cash flow of $43 billion. As the high-margin advertising business expands, profitability is expected to rise further.

While Shopify grows at a faster pace, Amazon demonstrates consistent performance against its larger revenue base of $620 billion, indicating potential for sustained growth in the future.

Choosing the Superior Stock

Comparing these two companies reveals challenges, as both are actively reducing costs while achieving profitability. Shopify is significantly smaller, targeting specific areas within the e-commerce supply chain.

Estimates suggest Shopify commands over 10% of the U.S. e-commerce market, compared to Amazon’s 40%. Additionally, Amazon’s cloud computing segment contributes nearly $100 billion in annual revenue and substantial profits.

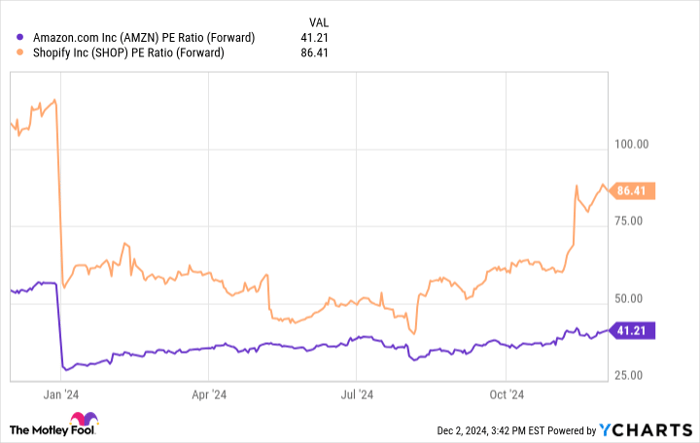

When it comes to valuations, Shopify’s market cap stands at $142 billion with a forward price-to-earnings (P/E) ratio of 86. In contrast, Amazon’s forward P/E is more attractive at just 41.

While Shopify may see slightly faster growth in the next five years, its valuation doesn’t justify such a high P/E compared to Amazon. Therefore, Amazon appears to be the more appealing investment opportunity at present.

Seize Your Moment for a Lucrative Investment

Have you ever felt like you missed out on investing in promising stocks? If so, this is your chance.

Our seasoned analysts occasionally recommend a “Double Down” stock, identifying companies poised for significant growth. If you’re concerned about missing an opportunity, now is a strategic time to invest before rates rise.

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $359,445!*

- Apple: A $1,000 investment in 2008 would have grown to $45,374!*

- Netflix: Investing $1,000 when we doubled down in 2004 would yield $484,143!*

The opportunity to invest in three remarkable companies is now available, and you may not see another chance like this soon.

View 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon, FedEx, and Shopify. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.