“`html

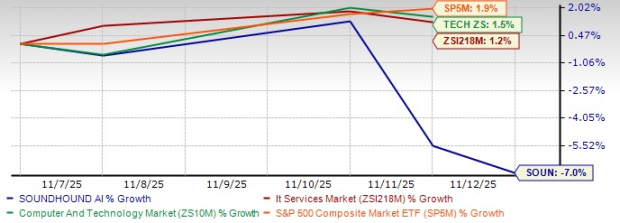

SoundHound AI, Inc. (SOUN) reported a 68% year-over-year revenue growth for Q3 2025, totaling $42 million, on November 6. Despite this strong performance, shares fell 7% post-earnings, underperforming the Zacks Computers – IT Services industry, which rose by 1.2%. Currently, SOUN shares are trading at a 47% discount to their 52-week high of $24.98 but remain over 121% above their low.

The company narrowed its non-GAAP net loss to $13 million and aims to reach breakeven by late 2025, driven by expected revenue doubling and operational efficiencies. Analysts forecast significant improvement in the bottom line, estimating losses of $0.13 per share in 2025 and $0.05 in 2026. However, SoundHound faces challenges such as a volatile GAAP net loss of $109.3 million due to acquisition charges and competition from major firms like Nuance Communications.

With $269 million in cash and no debt, SoundHound is positioned to invest strategically in the growing conversational AI market, yet concerns about profitability and operational costs may affect investor sentiment.

“`