Editor’s Note: Eric Fry here. The rapid advancement of technology has profoundly impacted market volatility. Despite the stock market’s impressive gains in recent years, it has also faced 19 of the largest single-day declines in the past 40 years.

Essentially, both volatility and sudden market drops have become standard, even during times of growth.

To tackle this evolving landscape, my InvestorPlace colleague Luke Lango has dedicated nearly a year to developing and testing a cutting-edge tool called Auspex. Luke will unveil this tool at The Auspex Anomaly Event on Wednesday, December 11 at 1 p.m. Eastern time. Reserve your spot for this event here.

Today, Luke will discuss the importance of adapting to shifting market conditions and how traditional “buy-and-hold” strategies now require more sophisticated approaches while introducing his new Auspex tool.

Over to you, Luke…

This past month has been the stock market’s strongest of the year, with the S&P 500 climbing nearly 6% in November.

Several factors have fueled this rise.

With plans for deregulation and tax reform, President-Elect Donald Trump aims to reshape the U.S. economy with pro-growth initiatives. This optimism is rekindling investors’ “animal spirits,” contributing to the ongoing market rally.

Since Election Day alone, we see notable gains:

- The S&P 500 has increased approximately 6.2%, consistently reaching new highs of 6,000 and more.

- The Russell 2000 index, which tracks small-cap stocks, has surged by about 9.7%.

- The tech-driven Nasdaq-100 has risen around 7.2%.

- Even Bitcoin (BTC-USD) has soared approximately 32%, climbing from $70,000 to an all-time high of over $100,000.

As we watch these trends, we ponder whether this remarkable rally can sustain itself through Trump’s inauguration and beyond.

While I believe it can, there’s also a possibility that it may falter sooner than expected.

Market rallies do not last indefinitely. Savvy investors must actively monitor their strategies rather than adopt a set-it-and-forget-it mentality.

This is why developing strategies that can thrive in both bear and bull markets is essential.

On December 11, I will unveil a powerful new strategy that addresses this need for adaptability. (Sign up now to reserve your spot for that event.)

For the past five months, I have been using this technique within a select group of subscribers, consistently outperforming the market each month, including November.

Let’s take a deeper look at history to understand why the current rally might not be as sustainable as we hope.

Additionally, I will provide insight into my new strategy, which involves minimal setup each month—no need for constant monitoring of prices or losses.

The Risks of Buy-and-Hold Strategies

The investment environment has seen substantial changes over the last few decades.

Nevertheless, many investors continue to cling to the belief in “buy and hold” as the best approach.

They often overlook how quickly market conditions can evolve.

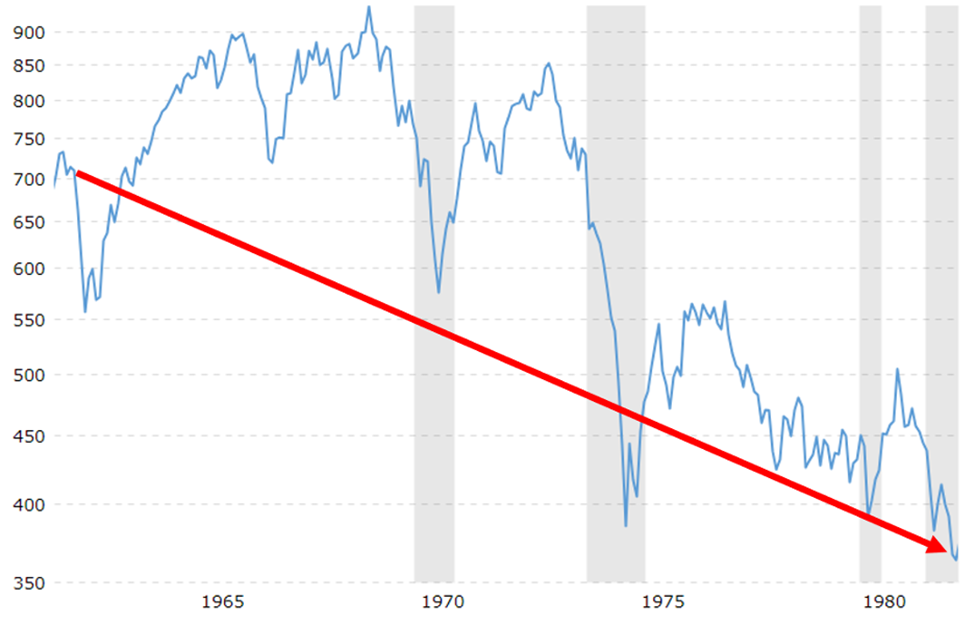

Looking back, between 1962 and 1982, the S&P 500 faced a prolonged bear market, plummeting from 713 to 363, representing a nearly 50% drop. In such an environment, buy-and-hold strategies became ineffective.

Source: Macrotrends.net

This era was marked by few stories of everyday workers building wealth through patience in investment.

The challenging market conditions led to the infamous BusinessWeek cover in 1979 titled “The Death of Equities.”

Investing Insights: Navigating the Market’s Volatility

Historical Market Performance Reveals Lessons from the Past

Investing in stocks during the 1960s and ’70s posed challenges, even for the most skilled investors. Major companies that seemed reliable often failed to deliver solid returns.

Take IBM Corp. (IBM) as an example. Once a respected leader in technology and a favorite among investors, IBM struggled during this time frame. Between winter 1962 and fall 1981, IBM managed to achieve only a 2.62% average annual return, which includes reinvested dividends.

Source: DQYDJ.com

A $10,000 investment in IBM would have grown to just $16,346 over 19 years—far from sufficient for a comfortable retirement.

Fast forward to the 2000s, a similar bear market emerged after the dot-com boom followed by the financial crisis.

Am I forecasting a repeat of those times? Not exactly.

Currently, a 25-basis-point interest rate cut is anticipated from the Federal Reserve, which may support ongoing stock market gains.

Nevertheless, rallies do not last forever. Eventually, investors will seek to cement short-term profits, particularly around election seasons.

While we aren’t at that point yet, it may come by the time of the inauguration.

The world is unpredictable, and policies from leaders like Donald Trump may amplify the uncertainties we face.

In the future, we might see global tensions, rising inflation, and fluctuating interest rates—all factors that could weigh down the stock market. While we may not encounter a slump like the 1960s and ’70s, a downturn is plausible.

Yet, with my new strategy, investors can still outperform the market, even amidst potential declines. Let’s explore how this can be achieved.

Proven Strategies for Succeeding in Today’s Markets

The “buy-and-hold” strategy remains relevant. I advise my members to invest in sectors like artificial intelligence, precision medicine, quantum computing, and nuclear energy. These sectors show great promise for long-term growth.

This approach can lead to building a multimillion-dollar portfolio over time, providing wealth and peace of mind.

However, given the market’s volatility, gaining short-term profits presents challenges. Diversifying our investment strategies beyond just buy-and-hold is essential.

Therefore, I encourage my subscribers to adopt active trading techniques that can capitalize on market fluctuations.

In line with this, we developed the Auspex strategy to transform uncertainty into stability.

I’ll delve deeper into this during the The Auspex Anomaly Event on Dec. 11 at 1 p.m. Eastern.

The Auspex system is designed to pinpoint “the best stocks at the best times.” This tool integrates fundamental, technical, and market sentiment data to identify stocks poised for strong performance in the coming month.

Each month, Auspex analyzes over 10,000 stocks to find those with significant fundamental strength, favorable technical trends, and positive sentiment, identifying stocks with the greatest upward potential.

Typically, Auspex highlights 5-20 stocks, which my team and I investigate to create each month’s Auspex Portfolio.

We’ve been implementing this approach live for a small group of members for five months, consistently achieving impressive results.

November saw the S&P 500 rise by 5.7%. By contrast, our Auspex portfolio experienced gains exceeding 8% during the same period.

Notably, this marks the fifth consecutive month where Auspex outperformed the market.

Back-testing shows that over multiple years, Auspex demonstrates more than 10 times the market performance across 5-, 10-, 15-, and 20-year periods.

In April 2024, Auspex flagged Dynagas LNG Partners LP (DLNG) and Zeta Global Holdings Corp. (ZETA) as having substantial momentum. During that month, DLNG surged nearly 30%, while ZETA climbed about 15%, despite the S&P 500 dropping around 4%.

Star Performers: Auspex Highlights DLNG and ZETA’s Impressive Gains

Market Overview: May Highlights

In our May back-test analysis, Auspex spotlighted two stocks: DLNG and ZETA. During this period, ZETA saw a remarkable increase of over 30%, while DLNG rose nearly 10%. In comparison, the S&P 500 made a modest gain of just 4%.

Significant Returns Amidst a Flat Market

In simple terms, the Auspex stocks DLNG and ZETA achieved respective increases of about 40% and 50% while the broader market remained relatively stable.

The Bottom Line

Looking ahead to 2025, the stock market is anticipated to be volatile and continually shifting, much like in the past few years. In such an environment, having tools that offer data-driven and flexible investment strategies will be crucial. This is precisely why we developed Auspex.

This platform allows investors not just to survive potential market disturbances but to thrive, aiming for returns that may surpass market norms.

To find out more, click here to sign up for The Auspex Anomaly Event. Remember to save the date for Wednesday, December 11, at 1 p.m. Eastern.

We look forward to your participation!

Sincerely,

Luke Lango

Editor, Hypergrowth Investing