“`html

Why the Invesco QQQ ETF Could Be Your Best Investment Move

Keeping investment strategies straightforward can be beneficial. Think about it like cooking: deviating from a recipe too much can spoil the dish—nobody wants a strange milkshake, for example. The same principle applies to investing.

In fact, by putting a significant part of your investments in funds that follow major stock indices, you can enjoy some peace of mind knowing that your portfolio will likely reflect market growth.

Let’s dive deeper into one standout index-linked exchange-traded fund (ETF) that may help you build wealth over time.

Image source: Getty Images.

Understanding the Invesco QQQ Trust Series I ETF

The Invesco QQQ Trust Series I ETF (NASDAQ: QQQ) is an index-linked ETF that tracks the Nasdaq 100 index. This index includes the 100 largest non-financial stocks listed on the Nasdaq stock exchange.

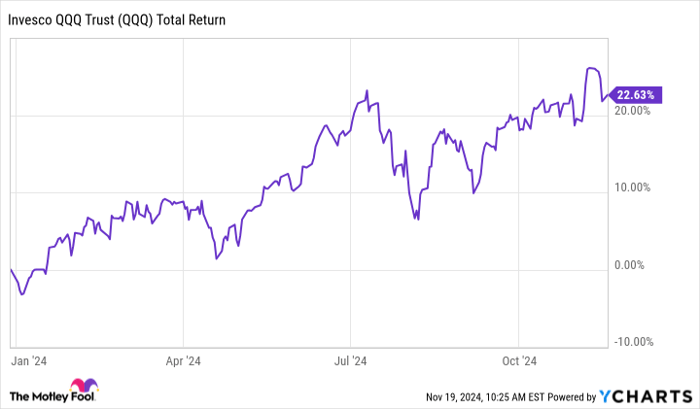

QQQ Total Return Level data by YCharts.

The index comprises major tech stocks like Nvidia, Microsoft, Apple, and Amazon. However, it also includes smaller companies such as Ansys, MongoDB, and The Trade Desk. Furthermore, some companies from outside the tech sector, like Starbucks, Kraft Heinz, and AstraZeneca, are part of this diverse portfolio.

Overall, the fund provides investors with access to a wide range of stocks from various sectors, although it is notably tech-heavy, with around 59% of its holdings in this industry.

Given the strong performance of tech stocks over the past few decades, investors should consider whether a greater emphasis on this sector might be wise. For young investors especially, being somewhat overweight in tech could be a potent long-term strategy.

The Benefits of Investing in Tech

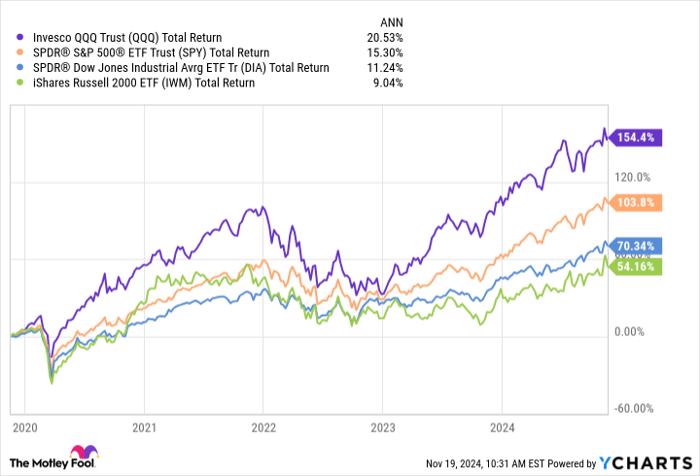

Let’s look at how the Invesco QQQ ETF has performed compared to three other index-linked ETFs: the SPDR S&P 500 ETF Trust, the SPDR Dow Jones Industrial Average ETF, and the iShares Russell 2000 ETF.

QQQ Total Return Level data by YCharts.

Over the past five years, the Invesco fund has notably outperformed its peers, achieving a compound annual growth rate (CAGR) of 20.5%. The gap widens further when we assess performance over the last 15 years, marking a distinct growth period beginning with the Great Recession’s end in March 2009.

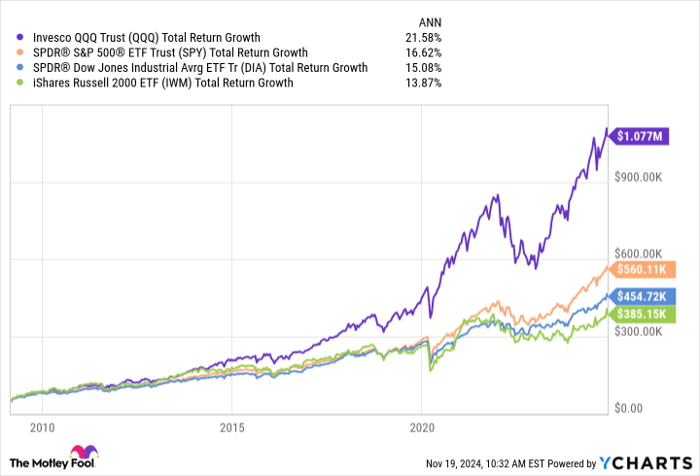

QQQ Total Return Level data by YCharts.

An investment of $50,000 in the Invesco fund back in March 2009 would have surpassed $1 million today. In comparison, the same amount invested in other funds—$560,000 in the S&P 500 ETF, $454,000 in the Dow ETF, and less than $386,000 in the Russell ETF—demonstrates the significant performance discrepancy.

The lesson is clear: even with good timing and similar ETF choices, performance can vary greatly, and the tech-heavy Invesco fund stands out as a strong winner.

Investment paths vary, but understanding this potential can be a game-changer for aspiring investors.

“““html

Assessing the Future of Invesco QQQ Trust: A Smart Investment Choice?

The Invesco QQQ Trust often promises solid returns, but can investors count on its continued success in the ever-changing market?

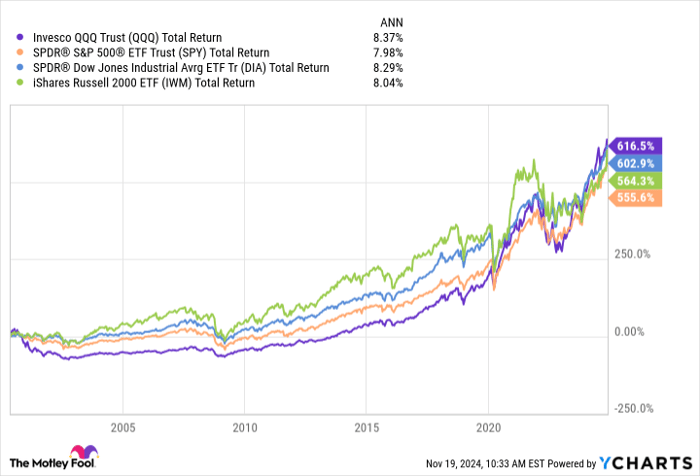

Experts warn that while the Invesco fund has shown strong performance, especially since the turn of the century, past market conditions, such as the tech downturn from 2001 to 2003, remind us that there are no guarantees in investing. Despite that historical volatility, the Invesco fund has subtly outperformed many of its significant index rivals.

QQQ Total Return Level data by YCharts.

While no investment is entirely risk-free, index-linked ETFs come close. These funds provide a diversified selection of stocks and have shown the ability to deliver consistent returns over the long term. The tech-focused nature of the Invesco fund may offer investors a promising opportunity for market outperformance, thanks to the strong growth potential and profitability of its key constituents.

Is Now the Right Time to Invest $1,000 in Invesco QQQ Trust?

Before making any purchases, consider this point:

The Motley Fool Stock Advisor analyst team has pinpointed their top 10 stocks for investors to buy at this time, and notably, Invesco QQQ Trust is not included. The selected stocks are expected to yield impressive returns in the upcoming years.

Remember when Nvidia was featured on this list on April 15, 2005? An initial investment of $1,000 would now be worth $898,809!

Stock Advisor delivers an accessible roadmap for investment success, offering portfolio-building advice, regular analyst updates, and two fresh stock picks each month. Since 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns data as of November 18, 2024

John Mackey, the former CEO of Whole Foods Market, which is now a subsidiary of Amazon, serves on The Motley Fool’s board. Jake Lerch has stakes in Amazon, Invesco QQQ Trust, The Trade Desk, and the iShares Russell 2000 ETF. Lerch also holds long and short options on SPDR S&P 500 ETF Trust. The Motley Fool maintains positions in and recommends Amazon, Apple, Microsoft, MongoDB, Starbucks, and The Trade Desk. Additionally, they recommend Ansys, AstraZeneca Plc, and Kraft Heinz, along with options related to Microsoft. The Motley Fool follows a strict disclosure policy.

The views and opinions expressed in this article are those of the author and do not necessarily represent those of Nasdaq, Inc.

“`