Deere & Company DE has issued a recall for approximately 147,900 compact utility tractors in the U.S. after reports indicated a potential brake failure risk. The safety-focused move aims to prevent any mishaps related to brake linkage defects, affecting models 1023E, 1025R, and 2025R sold from November 2017 to July 2024. The recall extends to an additional 16,800 units in Canada.

The trigger for the recall lies in a vulnerable front bell crank within the brake linkage system of the affected tractors. The Consumer Product Safety Commission (“CPSC”) highlighted the risk of breakage, warning of potential hazards in case of accidents. The safety concern has led to four incidents of brake linkage failure in the U.S., resulting in one hospitalization, two impact injuries, and minor damage to the tractors.

Putting Safety First: Deere’s Swift Response

Deere has taken a proactive stance by cooperating closely with the U.S. CPSC to swiftly address the brake issue. The company has advised impacted customers to refrain from operating their tractors until receiving a free repair service from authorized Deere dealers. With a wide network of over 2,000 dealerships across the U.S. and Canada, Deere ensures easy access to necessary repair services, going so far as to facilitate at-home repairs for customers unable to transport their tractors.

Weathering the Storm: DE’s Financial Performance in Q3

In a testing quarter marked by challenges, Deere reported third-quarter fiscal 2024 earnings of $6.29 per share, surpassing the Zacks Consensus Estimate of $5.80 despite a 38% drop from the prior year. The decline in bottom line figures can be attributed to decreased shipment volumes across all segments, reflecting subdued demand. However, the company’s adept pricing strategies and cost-saving measures helped mitigate the impact.

Equipment operations’ net sales, encompassing Agriculture, Turf, Construction, and Forestry, stood at $11.39 billion, a 19.9% decline year over year, although surpassing the Zacks Consensus Estimate. Total net sales, including financial services and others, amounted to $13.15 billion, down 16.8% year over year.

Forecasting the Future: Deere’s Net Income Projection for 2024

Against the backdrop of challenging landscapes in global agriculture and construction sectors, Deere anticipates aligning production with demand dynamics and implementing cost-cutting measures. The company maintains a net income guidance of $7 billion for fiscal 2024, indicative of a 31% slump from the $10.2 billion reported in fiscal 2023. Forecasts project a 20-25% decline in net sales for Production & Precision Agriculture, Small Agriculture & Turf, and a 10-15% decrease in sales for Construction & Forestry. Additionally, the Financial Services segment is projected to report net income of $720 million.

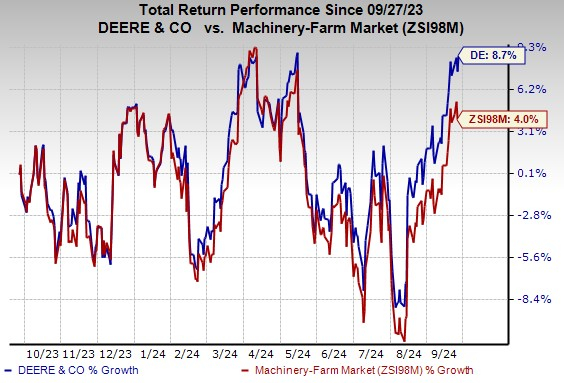

Despite the tumultuous operating environment, DE shares have outperformed the industry, posting an 8.7% gain over the past year compared to the industry’s 4% growth.

Image Source: Zacks Investment Research

Zacks Analysis and Stock Recommendations

DE currently holds a Zacks Rank #3 (Hold). Favorable stocks in the Industrial Products sector include Crane Company, Flowserve Corporation, and RBC Bearings Incorporated, each carrying a Zacks Rank #2 (Buy).

Crane Company’s 2024 earnings estimate is at $5.07 per share, with a 6% upward revision in the past 60 days. The company boasts a remarkable 11.2% average earnings surprise for the trailing four quarters, with its stock soaring by 75.2% over a year.

Flowserve Corporation demonstrates an 18.2% average earnings surprise and anticipates a 31.6% year-over-year growth in 2024 earnings, pegged at $2.76 per share. The stock has gained 27.5% over the past year.

RBC Bearings Incorporated is estimated to achieve earnings of $9.71 per share in fiscal 2025, indicating a 1.4% rise in estimates over the past 60 days. Notably, the company shows a 4.7% average earnings surprise and a stock growth of 27.2% in a year.

To read the original Zacks article, click here.

Market News and Data brought to you by Benzinga APIs