“`html

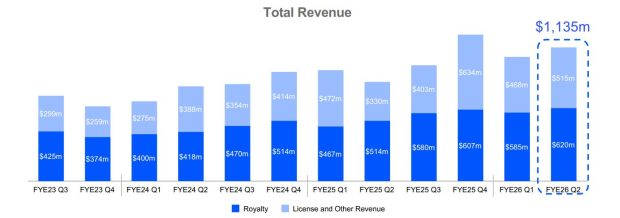

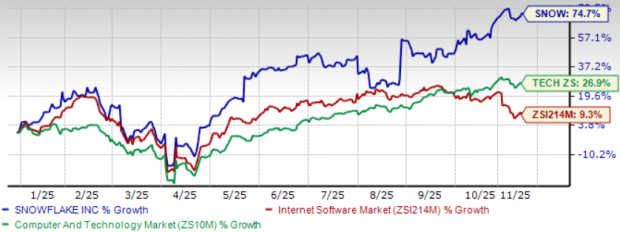

Arm Holdings plc reported Q2 fiscal 2026 revenues of $1.14 billion, an increase of 34% year-over-year, surpassing expectations by 6.5%. Despite this record quarter, the stock has decreased by 7% post-results announcement, indicating investor caution primarily due to concerns over valuation and AI adoption rates.

The company’s royalty revenues reached $620 million, up 21% year-over-year, while licensing revenues skyrocketed 56% to $515 million. Moving forward, Arm anticipates Q3 revenues between $1.175 billion and $1.275 billion, reflecting an expected growth of 25% year-over-year.

Operating income climbed to $467 million, yielding a 41.1% operating margin. However, R&D costs increased 31% year-over-year to $648 million. The current market sentiment is cautious, with Arm Holdings rated as a Sell, suggesting investor hesitation amid high valuations compared to industry standards.

“`