“`html

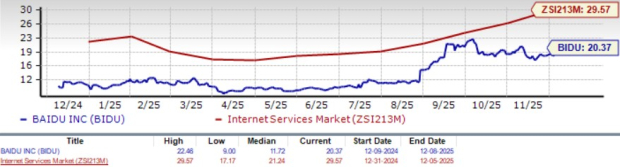

Baidu, Inc. (BIDU) reported a significant valuation discount, trading at a forward price-to-earnings ratio of 20.37x compared to the Zacks Internet-Services industry’s 29.57x and the Zacks Computer and Technology sector’s 29.03x. The company anticipates a fourth-quarter earnings per share projection of $1.50, marking a 42.97% decrease year-over-year. Meanwhile, its online marketing revenues declined by 18% year-over-year to RMB 15.3 billion in Q3 2025, reflecting ongoing weakness in China’s advertising market.

BIDU’s autonomous driving platform, Apollo Go, provided 3.1 million fully driverless rides in Q3 2025, up 212% year-over-year, bringing total rides beyond 17 million by November 2025. The AI Cloud Infrastructure generated RMB 4.2 billion in revenues, a 33% increase year-over-year. Despite these advances, BIDU faces structural headwinds in its core advertising segment and trails behind competitors like Alibaba and Tencent in shareholder returns, achieving a 45.8% growth over the past year.

As of now, BIDU’s overall market performance suggests cautious investor sentiment, characterized by mixed earnings estimate revisions and a Zacks Rank #3 (Hold). Investors are advised to consider positioning as the company navigates challenges with its existing advertising business versus growth in AI and autonomous initiatives.

“`