“`html

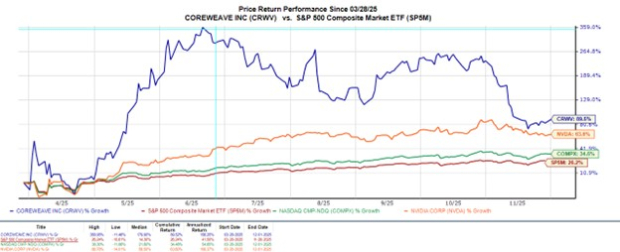

CoreWeave Inc. (CRWV), an AI cloud provider backed by Nvidia, has seen its stock rise by 90% since its IPO earlier this year, but it has now fallen over 50% from its peak of $187 due to concerns about slowing growth, heavy debt, and disappointing guidance. The company’s Q3 sales reached $1.34 billion, more than doubling year-over-year, yet it lowered its fiscal 2025 revenue forecast to $5.05-$5.15 billion, down from $5.35 billion, citing delays in major contracts.

CoreWeave also reported operating margins below 4%, and despite an adjusted loss of $0.08 per share in Q3, full-year EPS expectations changed to -$1.39 from -$1.52. The company holds $32.91 billion in assets against $29 billion in liabilities, and continues to secure new contracts, including deals with Meta Platforms and OpenAI. CoreWeave’s revenue backlog stands at $56 billion, fueling optimism for future growth.

Currently, CoreWeave’s stock is seen as moderately valued with a forward price-to-sales ratio of 5X, significantly lower than competitors like Nvidia at 22X. Analysts suggest that CoreWeave’s ability to manage debt and deliver on its backlog will be crucial in determining its future performance.

“`