“`html

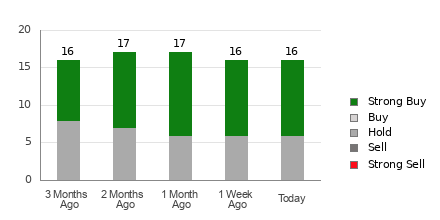

Evercore ISI Group has maintained an Outperform recommendation for Apple (NasdaqGS:AAPL) as of December 8, 2025. The average one-year price target for Apple is $286.45 per share, indicating a potential upside of 2.75% from its latest closing price of $278.78.

Projected annual revenue for Apple is $458.65 billion, reflecting a 10.21% increase. As of now, there are 7,672 funds reporting positions in Apple, a decrease of 41 funds (0.53%) since last quarter. Total shares owned by institutions have decreased by 2.86% over the last three months, totaling 10,354,450K shares.

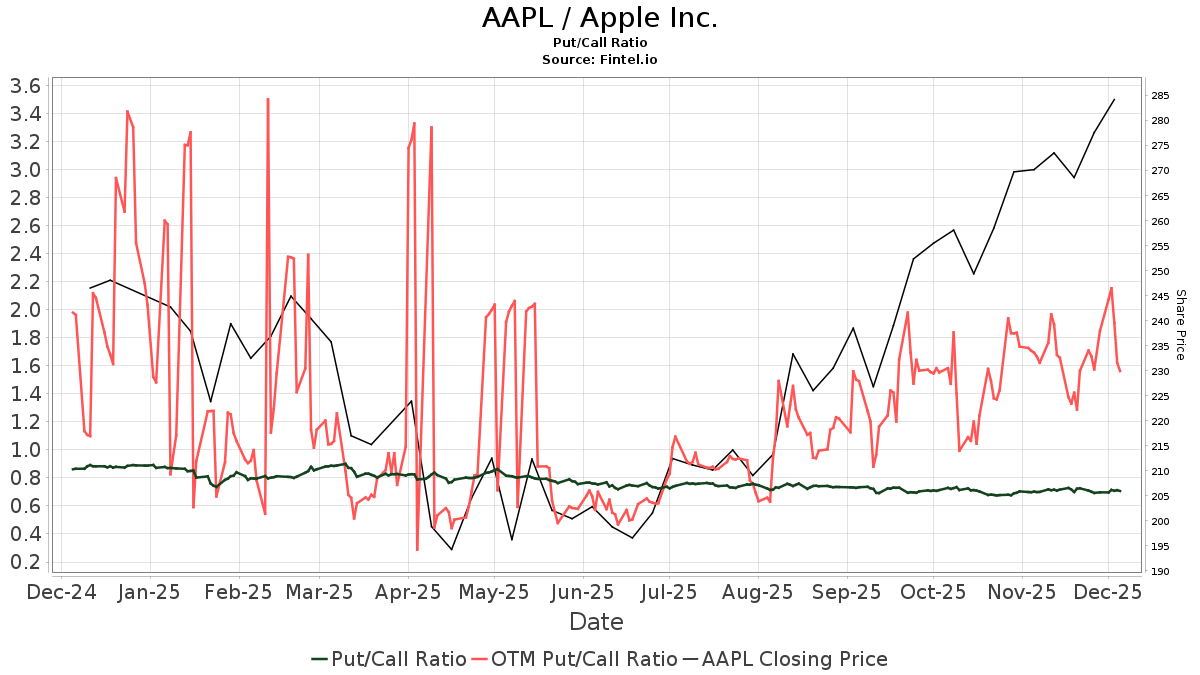

The put/call ratio for AAPL stands at 0.69, suggesting a bullish outlook. Major shareholders include Vanguard Total Stock Market Index Fund Investor Shares with 480,284K shares (3.25% ownership), Berkshire Hathaway with 238,213K shares (1.61% ownership), and J.P. Morgan Chase with 236,656K shares (1.60% ownership).

“`