The U.S. Stands Tall as Global Growth Leader, Driven by AI Investments

JPMorgan’s Latest Analysis Highlights Promising Prospects for Tech Giants.

Late last month, JPMorgan analysts stated that with other global regions facing various challenges, the U.S. is set to remain the leader in global growth. A significant part of this assertion is rooted in advancements in artificial intelligence (AI).

According to a recent report by Benzinga, AI “is sparking a capital expenditure boom that dwarfs anything seen in decades.” In particular, the companies known as the Magnificent 7 – Amazon.com Inc. AMZN, Microsoft Corp MSFT, Meta Platforms Inc META, NVIDIA Corp NVDA, Alphabet Inc. GOOG, Tesla Inc TSLA, and Apple Inc AAPL – are projected to invest over $500 billion in capital expenditures and research and development (R&D) in the coming year.

This significant investment would account for around 25% of these tech giants’ total sales. Additionally, JPMorgan forecasts that spending across the broader AI ecosystem might exceed $1 trillion by year-end. This figure encompasses costs related to infrastructure, engineering experts, and data center operations.

The individual members of the Magnificent 7 continue to capture attention. Recently, Hartmut Neven, the founder and head of Google Quantum AI, introduced Willow, a new quantum chip. He described it as a major technological breakthrough, capable of outstanding performance while significantly reducing errors.

In the automotive sector, German automaker BMW BMWYY acknowledged on social media that Tesla’s latest iteration of its full self-driving (FSD) software is “very impressive.” Gary Black, Managing Partner at The Future Fund, highlighted that Tesla may opt to license its FSD technology to other automakers, reflecting sentiments expressed by Tesla CEO Elon Musk.

Concerns from JPMorgan Analysts: Despite the excitement surrounding the Magnificent 7, analysts from JPMorgan caution that challenges lie ahead. They raised concerns about potential capital misallocation and high growth expectations, which could lead to skepticism among investors by the end of next year. The ability to navigate both positive and negative narratives may become increasingly important, particularly for Direxion’s innovative exchange-traded funds (ETFs).

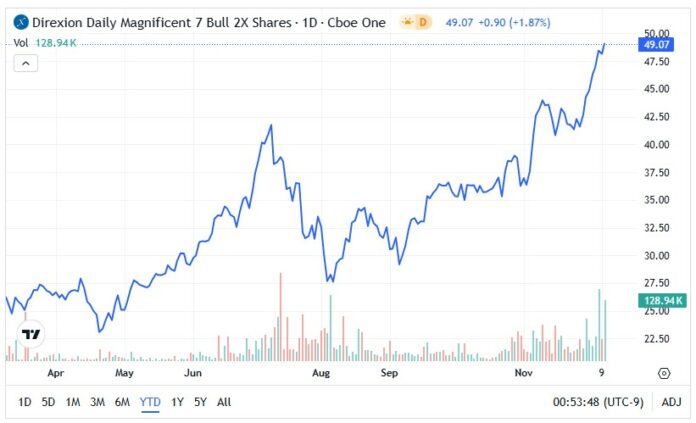

The bullish investors might be drawn to the Direxion Daily Magnificent 7 Bull 2X Shares QQQU. This fund, heavily weighted towards Tesla, aims to deliver 200% of the performance of the Indxx Magnificent 7 Index. Conversely, bearish investors could consider the Direxion Daily Magnificent 7 Bear 1X Shares QQQD, which seeks to provide 100% of the inverse performance of the same index.

For investors, both the QQQU and QQQD ETFs offer easy ways to speculate on market movements. They provide access to top technology stocks all in one place, allowing for leveraged or short positions without the complications of options trading.

It’s essential to note that Direxion advises investors against holding positions in either ETF for more than one day due to potential value erosion caused by daily volatility compounding.

The QQQU ETF Performance: The QQQU 2x bull fund has experienced a remarkable climb since its launch in March, achieving an 87% increase.

- Currently, this leveraged ETF remains well above its 20-day exponential and 50-day simple moving averages, indicating strong momentum.

- However, despite recent high trading volume, QQQU has displayed a candlestick pattern similar to a “shooting star,” which could signal a temporary overextension.

The QQQD ETF Performance: In contrast, the QQQD ETF has faced difficulties since its launch in March, with a drop of approximately 31%.

- This bear fund has noticeably fallen below its 20-day exponential moving average and 50-day simple moving average, raising significant concerns.

- Yet, the bear ETF may have formed a “hammer” candlestick pattern, hinting at a possible temporary halt in its downward trend.

Featured photo by Kohji Asakawa on Pixabay.

Market News and Data brought to you by Benzinga APIs