Goldman Sachs Initiates Coverage of TechnipFMC with Buy Rating

Forecast Points to Potential Growth

On December 13, 2024, Goldman Sachs began covering TechnipFMC (LSE:0RMV) with a Buy recommendation. As of December 3, 2024, analysts have set the average one-year price target at 30.88 GBX per share. This projection indicates a potential increase of 4.63% from its most recent closing price of 29.52 GBX. Prices among forecasts range from a low of 8.12 GBX to a high of 36.73 GBX, highlighting varying perspectives on TechnipFMC’s future.

Projected Revenue and Earnings Insights

In terms of revenue, TechnipFMC is expected to generate approximately 8,561 million (MM), reflecting a slight decrease of 2.68%. The forecasted non-GAAP earnings per share (EPS) stands at 1.00. These figures provide insight into the company’s financial stability as it navigates market trends.

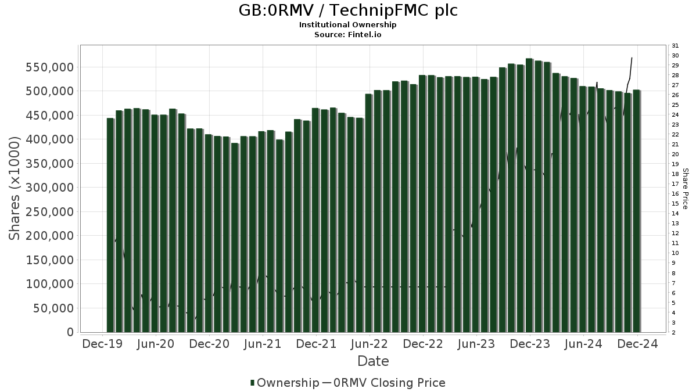

Institutional Ownership Trends

According to recent reports, 978 funds or institutions hold stakes in TechnipFMC, marking an increase of 20 fund owners or 2.09% in the last quarter. The collective portfolio weight of all funds dedicated to 0RMV is now 0.41%, up by 6.46%. Over the past three months, institutions have increased their share ownership by 0.70%, totaling 502,693K shares.

Key Institutional Stakeholders

Price T Rowe Associates now holds 56,931K shares, which equates to 13.38% ownership of TechnipFMC. This is an increase from their earlier report of 49,640K shares, reflecting a rise of 12.81%. The firm’s allocation in 0RMV saw a 10.68% uptick over the previous quarter.

T. Rowe Price Investment Management holds 41,801K shares, representing 9.83% ownership, up from 39,988K shares, or an increase of 4.34%. Their portfolio allocation increased by 0.18% during the last quarter.

In contrast, J.P. Morgan Chase’s stake decreased by 6.43%, now holding 21,856K shares, down from 23,262K shares. Their portfolio allocation fell dramatically by 94.11% over the last quarter.

Other notable stakeholders include the T. Rowe Price New Horizons Fund, which holds 20,921K shares (4.92% ownership, an increase of 14.34%) and the Vanguard Total Stock Market Index Fund, owning 12,910K shares (3.03%, a 0.32% increase).

Fintel serves as a highly resourceful platform for investors, providing insights into fundamentals, analyst ratings, fund sentiment, and much more.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.