Goldman Sachs Begins Coverage of Coty with Neutral Outlook

On December 13, 2024, Goldman Sachs initiated its coverage of Coty (BIT:1COTY), offering a Neutral recommendation.

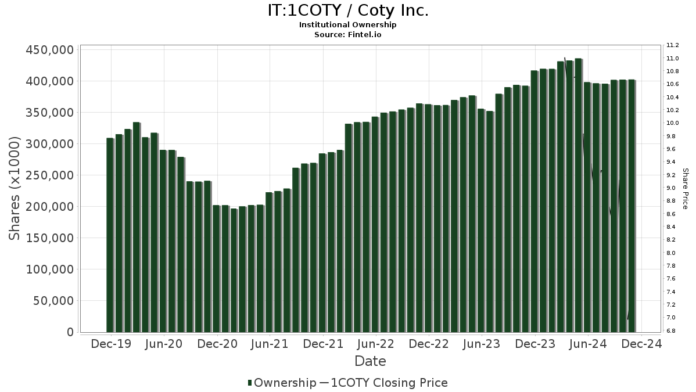

Institutional Ownership Trends

Currently, 665 funds or institutions hold positions in Coty, which remains unchanged from the previous quarter. The average portfolio weight of all funds invested in 1COTY is now 0.12%, representing an increase of 19.19%. Nevertheless, total shares held by institutions have seen a slight decline, dropping by 1.06% to 411,702K shares over the last three months.

Bnp Paribas Arbitrage currently holds 34,097K shares, which equates to 3.92% ownership of Coty. This shows a minor increase from the 34,064K shares reported previously, reflecting a change of just 0.10%. However, the firm has reduced its portfolio allocation in 1COTY by 22.64% during this past quarter.

Banco Santander’s position consists of 23,113K shares, amounting to 2.66% ownership. The firm previously reported owning 23,034K shares, which is an increase of 0.34%, but they have also cut back their portfolio allocation in 1COTY by 30.34% in the last quarter.

Credit Agricole S A has a stake of 20,717K shares, representing 2.38% ownership. Their previous holdings of 20,682K shares show a 0.17% increase, even as they decreased their allocation to 1COTY by 24.93% recently.

Ameriprise Financial has reduced its holdings to 18,039K shares, which is 2.07% ownership. Their last report indicated 18,107K shares, marking a decrease of 0.37%, and a significant 83.83% reduction in their portfolio allocation in the latest quarter.

FIL holds 11,818K shares, equivalent to 1.36% ownership. Previously, they reported possessing 7,317K shares, representing a remarkable increase of 38.08%. However, their allocation in 1COTY has seen a decrease of 21.98% over the last quarter.

Fintel is known for providing in-depth investing research tools tailored for individual investors, traders, financial advisors, and smaller hedge funds.

The platform includes a wealth of data covering fundamentals, analyst evaluations, ownership statistics, fund sentiment insights, options activity, insider trading, and much more. Moreover, their exclusive stock recommendations are driven by sophisticated, backtested quantitative models designed for better profitability.

For more information, click here.

This article first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.