Riot Platforms Signals a Possible Downturn: What Analysts Are Saying

Riot Platforms, Inc. RIOT shares have not seen much change on Thursday, but experts suggest this trend may shift soon.

Technical Analysis Points to a Sell Signal

A recent analysis using a moving average crossover strategy has indicated a sell signal for the stock. This development has led our team of analysts to highlight it as our Stock of the Day.

Understanding Moving Average Crossover Strategies

Moving average crossover strategies are widely used on Wall Street due to their straightforward nature and objective results.

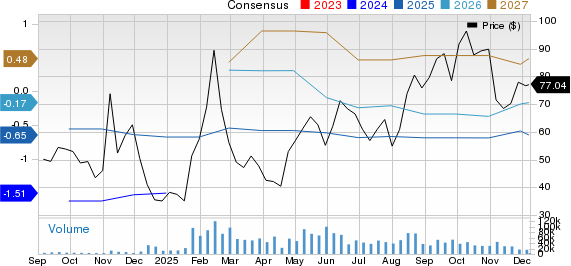

In the analysis, the red line represents the 20-day simple moving average, which reflects the average closing price over the last 20 days.

The blue line illustrates the 10-day simple moving average, denoting the average closing price from the previous ten days.

If the 10-day average exceeds the 20-day average, it indicates a potential upward trend for the stock. Conversely, if the 10-day average falls below the 20-day average, it raises the likelihood of a downward trend.

A Look at Recent Trade Signals

An analysis of recent signals for Riot shows a buy signal emerged in July, which was quickly followed by a sell signal in early August, resulting in nearly a breakeven position.

A favorable buy signal reappeared in late September when shares traded at around $7.40. Following this, a sell signal was issued when the stock reached approximately $12.20, leading to a profit in this trade.

The current sell signal indicates that Riot might face a decline ahead.

Why Traders Favor These Strategies

The popularity of moving average crossover strategies can be attributed to their objective nature, helping traders avoid the pitfalls of guesswork, which often leads to losses.

Ultimately, this method simplifies trading decisions, increasing the chances of profitability.

Further Reading

Michael Saylor Says MARA On The ‘Bitcoin Standard’ As Company Doubles Market Cap, Stock Price In Last 3 Months

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs