The Race to $5 Trillion: Can Nvidia Reach This Milestone by 2025?

Nvidia (NASDAQ: NVDA) has emerged as one of Wall Street’s top-performing stocks over the past two years, positioning itself alongside Apple as one of the largest companies globally. Currently, Nvidia boasts a market capitalization of $3.4 trillion, significantly on its way to the $5 trillion target projected by analysts.

Given Nvidia’s impressive performance in recent years, a 47% increase to reach $5 trillion appears feasible, but it will require substantial effort from the company.

Fresh Opportunities Await Nvidia in 2025

Despite its success, Nvidia’s ascent is backed by solid financial numbers. Since the beginning of 2023, the company’s revenue has surged by 320%, while profits have skyrocketed by 1,340%. This strong performance explains a staggering 600% increase in its stock price over the same period.

Typically, rising stock prices and profit increases tend to correlate, suggesting that Nvidia still has room for growth, particularly with 2025 on the horizon.

The currently deployed Hopper architecture is outpacing competitors in the graphics processing unit (GPU) market. Anticipation is building for the upcoming Blackwell Architecture, which is expected to significantly enhance Nvidia’s capabilities, delivering four times faster performance in training AI models. Such advancements are likely attracting interest from top AI developers.

Nvidia’s largest clients anticipate an increase in revenue, even though the company refrains from naming them specifically. Four clients combined contribute about 40% of quarterly revenues. Among them, Meta Platforms has indicated higher capital expenditure projections for 2025 as it expands its AI computing capabilities.

However, Meta is not alone in this demand shift. Major players in cloud computing, including Microsoft, Amazon, and Alphabet, are all experiencing rising demand for AI technology, and they’re likely to increase spending with Nvidia as well. This trend signals continuous growth for Nvidia’s business through the upcoming year.

Can Nvidia Achieve a $5 Trillion Market Cap?

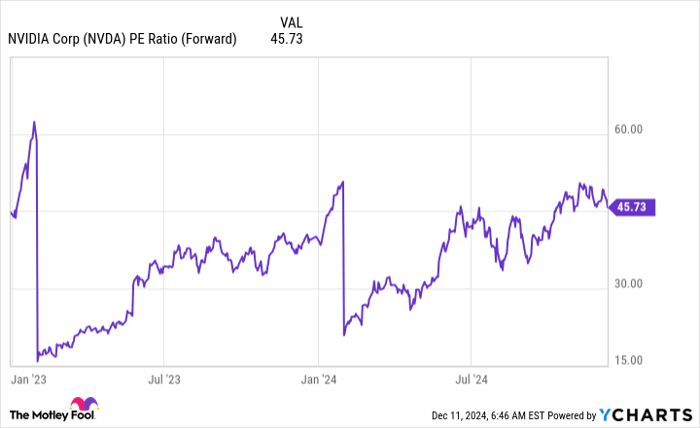

As Nvidia approaches its FY 2026 (ending January 2026, encompassing most of 2025), Wall Street analysts predict substantial growth of 51% in revenue and 50% in earnings per share (EPS). These promising figures suggest the stock price could rise similarly, but with a forward price-to-earnings ratio of 45, Nvidia is not exactly inexpensive.

NVDA PE Ratio (Forward) data by YCharts.

As growth is expected to decelerate, the current valuation might present a premium over time. Nonetheless, given Nvidia’s impressive growth trajectory and strong business foundation, the price could be justifiable if demand stays robust through 2026.

If Nvidia meets or exceeds its projected results and maintains strong demand into 2026, the prospect of achieving a $5 trillion market cap by the end of 2025 seems plausible. Thus, the stock appears to be a compelling buy at the moment.

A Unique Investment Opportunity Awaits

Ever think you missed out on investing in notable companies? This might be your second chance.

Occasionally, our expert analysts recommend a “Double Down” stock — a company they believe is on the verge of significant growth. If you’re concerned about missing your chance, investing now could be prudent before it’s too late. Here’s what past recommendations have yielded:

- Nvidia: A $1,000 investment in 2009 would be worth $356,125!*

- Apple: A $1,000 investment in 2008 would be valued at $46,959!*

- Netflix: A $1,000 investment in 2004 would now be $499,141!*

We’re currently issuing “Double Down” alerts for three exceptional firms, and this might be an opportunity not to be missed.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a member of the board. Randi Zuckerberg, former spokesperson for Facebook and sister of CEO Mark Zuckerberg, is among the board members as well. Keithen Drury holds positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has stakes in and recommends several companies including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. Additionally, The Motley Fool recommends certain options on Microsoft. The Motley Fool operates under a disclosure policy.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.