Could Marvell Technology Be the Next AI Powerhouse?

Technology giant Nvidia (NASDAQ: NVDA) has led the way in artificial intelligence (AI) innovation. The company’s processors are crucial to data centers and have propelled Nvidia’s stock to an impressive increase of more than 800% over the past two years, significantly outpacing the S&P 500, which rose by 58% in the same period.

Introducing Marvell Technology: A Hidden Gem

Not everyone may be familiar with Marvell Technology (NASDAQ: MRVL). With a market cap under $100 billion, it doesn’t receive the same attention as Nvidia, which boasts a whopping $3 trillion market value. Recent reports show that Marvell was not one of the top positions for hedge fund billionaires looking for the next big technology breakthrough. However, it’s time to take notice of what Marvell offers.

Marvell plays a vital role in the AI sector without being a household name. The company produces a range of products, including data center switches, hard drive controllers, and lesser-known computer processors. Its technology is used in 5G equipment, automobiles, and, importantly, AI data centers, which require advanced hardware to function effectively.

Recently, Marvell launched its Aquila DSP (digital signal processor), capable of processing 1.6 trillion bits of data per second. This efficient design can fit into tightly packed data centers, accommodating significant connectivity needs. Dell’Oro Group predicts a remarkable growth rate of 200% per year for this new type of data center processor over the next five years.

In addition, Marvell announced a breakthrough in high-bandwidth memory (HBM) modules, which can enhance AI platform performance by 25% without needing more space. According to Mordor Intelligence, the global HBM market is expected to grow at nearly 26% annually through 2029.

Positive Trends Despite Recent Stock Surge

Marvell’s growth is reflected in its stock price, which has surged over 200% since the end of 2022. About half of this increase occurred just since the middle of this year, driven by its research and development achievements.

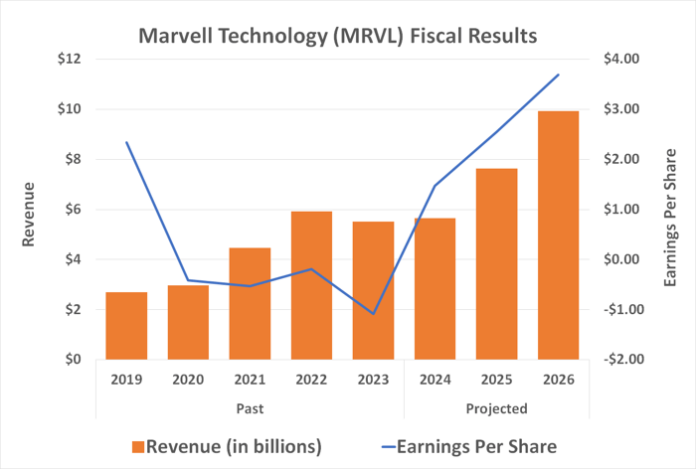

The company’s stock is currently valued at 40 times next year’s expected earnings of $2.76 per share. Despite seeming high, this valuation aligns with trends seen in high-growth sectors, where future potential often justifies elevated prices.

Marvell is strategically positioned to capitalize on the growing AI technology market. Analyst Cody Acree has raised Marvell’s target stock price, noting that it is one of only two suppliers of custom silicon for Nvidia’s GPU competitors. Major tech companies, including Amazon and Google, have partnered with Marvell to develop tailored accelerators for their AI needs.

Acree asserts that these partnerships are beginning to yield results, with expectations of marvellous revenue growth in FY25 and FY26, projecting $1.5 billion and $2.5 billion, respectively.

Data source: StockAnalysis.com. Chart by author.

The outlook for Marvell remains optimistic, with most analysts rating it as a strong buy, despite its recent price increases.

Should You Invest in Marvell Now?

Will big-name investors ultimately embrace Marvell Technology? It’s uncertain, as trends can take time to shift. Historically, some high-profile investors were initially hesitant about Nvidia’s rising success.

If you see potential in Marvell’s fundamentals and the broader market, consider investing now while the stock is still within your reach.

Seize the Opportunity Before It’s Gone

If you feel like you’ve missed opportunities to invest in successful companies, take note. Occasionally, analysts recommend what they label as a “Double Down” stock—companies poised for significant growth.

Current alerts spotlight three impressive firms showing potential for substantial growth, as past recommendations have proven highly profitable:

- Nvidia: A $1,000 investment in 2009 would now be worth $348,112!*

- Apple: A $1,000 investment in 2008 would now be worth $46,992!*

- Netflix: A $1,000 investment in 2004 would be valued at $495,539!*

This might be your chance to act before the window closes.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool recommends Marvell Technology. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.