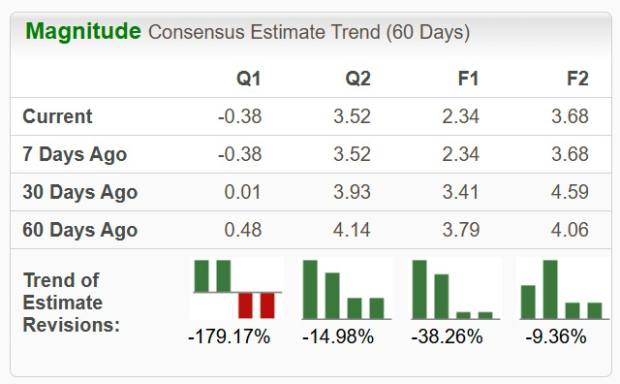

JAKKS Pacific, Inc. (NASDAQ: JAKK), a toy company headquartered in Santa Monica, California, has faced significant challenges, including a 284% average earnings miss over the past four quarters. Analysts have downgraded their 2025 earnings per share forecast by 38.26% to $2.34 due to ongoing revenue pressures from lower orders and tariff uncertainties.

Presently ranked #5 (Strong Sell) by Zacks, JAKKS Pacific operates mostly on a Freight-On-Board basis and has seen its stock decline over 40% since February 2023, contrasting sharply with the broader market’s gains. The company operates within the bottom 2% of the Zacks Toys – Games – Hobbies industry, signaling a challenging outlook ahead.

Recent performance trends reveal insufficient momentum to overcome these headwinds, maintaining shares below both the 50-day and 200-day moving averages. Notably, JAKK shares are characterized by volatility, with a history of negative earnings revisions suggesting that investors should remain cautious.