“`html

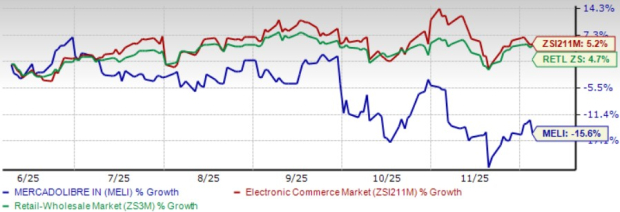

MercadoLibre (MELI) shares have declined 15.6% over the past six months, significantly underperforming the Zacks Retail-Wholesale sector and the Zacks Internet-Commerce industry’s growth of 4.3% and 5.2%, respectively. Investor concerns focus on margin compression due to aggressive investments, increased competition, and macroeconomic volatility in Latin America.

In Q3 2025, MELI saw a 26% year-over-year increase in unique active buyers to 76.8 million, while monthly active fintech users rose 29% to 72.2 million. However, the operational strategy prioritizing market share has led to a decline in operating margin to 9.8%, a decrease of 70 basis points from the previous year. The Zacks Consensus Estimate for Q4 2025 revenues stands at $8.45 billion, reflecting a growth of 39.5% year-over-year, yet profitability remains under pressure.

MELI trades at a forward P/E multiple of 34.91, higher than the Zacks Industry average of 24.37 and the broader sector’s 24.95, indicating high expectations for revenue growth while raising concerns over sustainability. The company currently holds a Zacks Rank #3 (Hold), suggesting that investors may want to monitor profitability trends before making new positions.

“`