“`html

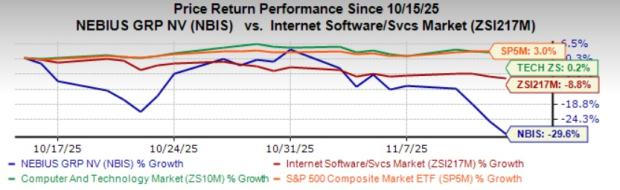

Nebius Group N.V. (NBIS) reported a third-quarter 2025 adjusted net loss of $100.4 million, a 153% increase from a loss of $39.7 million in the prior year. The company’s revenue reached $146.1 million, up 355% year over year, driven by a 400% increase in its core infrastructure segment. However, shares have dropped 20.4% since its earnings release on November 7, 2025, and are down approximately 30% over the past month, significantly underperforming the Zacks Internet Software Services industry’s decline of 8.8%.

Nebius has adjusted its full-year revenue outlook down to $500 million to $550 million from a previous estimate of $450 million to $630 million, attributing the change to the timing of new capacity coming online. Operating costs surged 145% to $276.3 million, and the company now faces escalating expenses amid macroeconomic uncertainties and heavy capital spending, which has increased its guidance for capital expenditures from approximately $2 billion to around $5 billion.

Despite these challenges, Nebius is pursuing aggressive expansion plans, aiming for 2.5 GW of contracted power by 2026 while strengthening its position with multi-billion-dollar agreements with major tech firms like Microsoft and Meta. However, the stock currently carries a Zacks Rank #4 (Sell), raising concerns among investors about the risk-reward balance ahead of further developments.

“`