Nvidia’s Stock Surges to New Heights: A $3.40 Trillion Milestone

Shares of microchip designer Nvidia (NVDA) closed at an all-time high, with its market capitalization reaching an impressive $3.40 trillion.

Second Most Valuable Company in the World

Nvidia now stands as the second most valuable publicly traded company globally, trailing only Apple (AAPL), which boasts a market cap of $3.52 trillion. On October 14, Nvidia’s share price soared by 2.43% to finish trading at $138.07, marking a record high on a split-adjusted basis. It’s important to note that Nvidia executed a 10-for-1 stock split in June of this year.

The previous record for Nvidia stock was $135.58, reached on June 18, shortly after the stock split. During the summer, NVDA experienced a downturn but has seen a significant recovery over the past six weeks. Since September 6, Nvidia’s stock has surged by 35%. The stock is up 179% year-to-date and has increased nearly tenfold since the beginning of 2023.

Nvidia’s Growth Driven by AI Demand

The upward trajectory of Nvidia’s share price can be attributed to growing interest in AI microchips and processors, which the company produces. As earning reports for the third quarter approach, analysts and investors are increasingly optimistic.

Nvidia’s processors are regarded as the most effective options for running AI models and applications. Recently, the company began shipping its most advanced microchips, known as the Blackwell line, with executives describing the demand for these chips as “insane.” According to analysts at Mizuho Financial Group (MFG), Nvidia commands approximately 95% of the market for chips used in AI training.

Is NVDA Stock Worth Investing In?

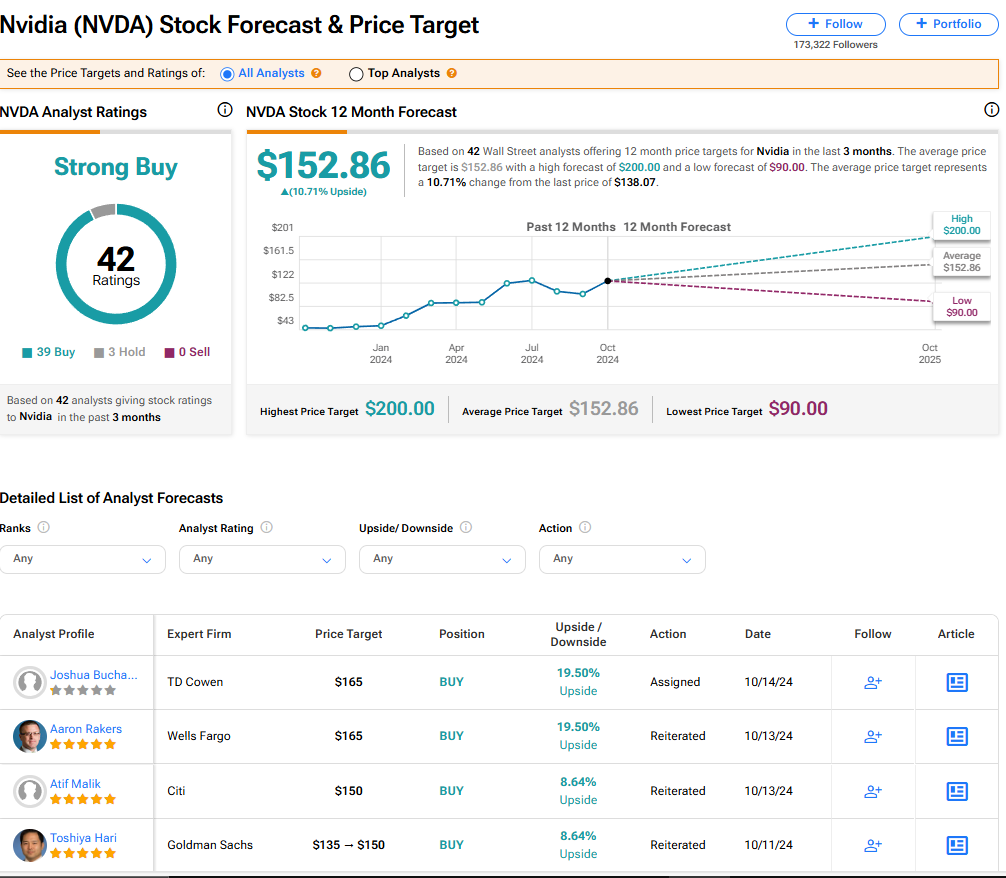

The consensus among 42 Wall Street analysts is that Nvidia stock holds a “Strong Buy” rating. This assessment is based on 39 Buy recommendations and three Hold recommendations made in the last three months, with no analysts advising a Sell. The average price target for NVDA stands at $152.86, indicating a potential upside of 10.71% from current trading levels.

Explore additional analyst ratings on NVDA stock

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.