Nvidia Achieves $4 Trillion Market Valuation Amid AI Demand

Nvidia (NASDAQ: NVDA) has reached a historic valuation of $4 trillion, marking it as the world’s first company to do so, primarily driven by soaring demand for its high-end graphics processing units (GPUs) essential for artificial intelligence (AI) infrastructure. Over the last three years, its value skyrocketed over tenfold, leading in AI chip development despite emerging challenges from competitors and custom silicon initiatives from major clients like Meta Platforms and Microsoft.

However, Nvidia’s growth faces potential hurdles as its major customers are increasingly investing in their own silicon designs. Additionally, recent news indicates that the U.S. plans to lift the ban on the sale of certain Nvidia chips to China, in which Nvidia had previously written off $4.5 billion due to related regulations. Analysts project Nvidia’s stock could rise to $200 per share, equating to a market cap of $4.9 trillion.

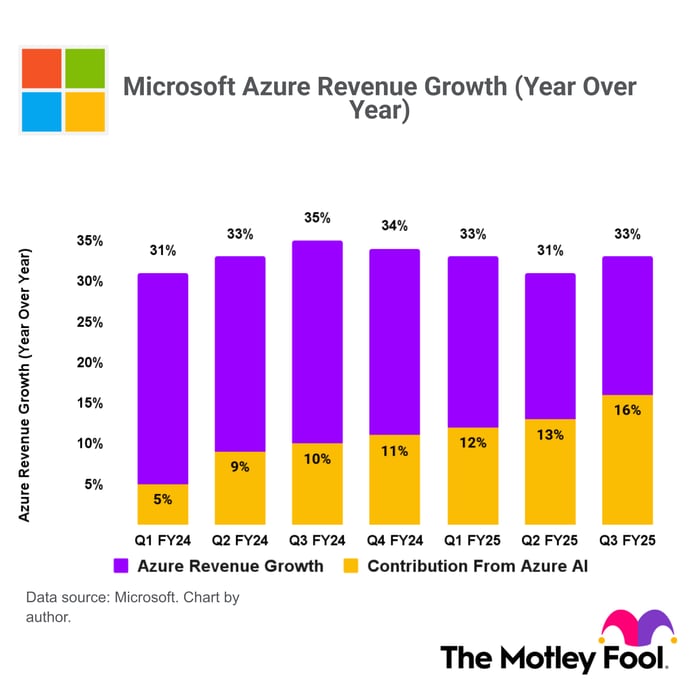

As of now, Microsoft is positioned closely behind Nvidia, with a current valuation around $3.8 trillion. Analysts predict it may reach $4 trillion soon, backed by strong growth in its Azure cloud services and custom AI solutions. Microsoft’s cloud infrastructure and AI tools are triggering increased demand, positioning the company as a formidable competitor in the AI sector.