“`html

Nvidia’s Growing Dominance in AI Hardware

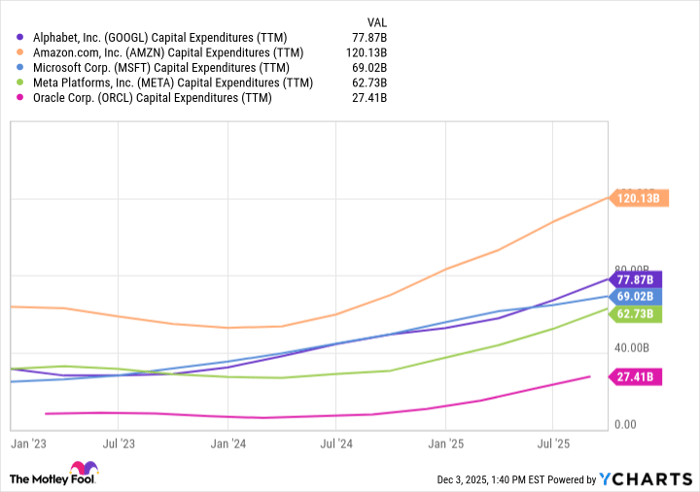

Nvidia (NASDAQ: NVDA) is currently the leading provider of data center chips optimized for artificial intelligence (AI) workloads, with projections estimating $4 trillion in annual AI infrastructure spending by 2030. In fiscal year 2026, the company anticipates generating a record $212 billion in revenue, with nearly 90% attributed to its data center segment.

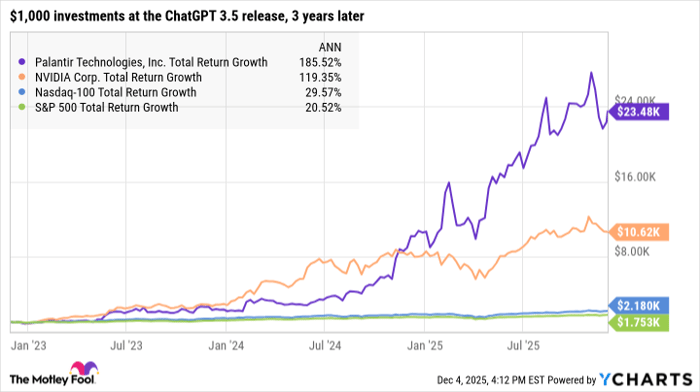

The demand for Nvidia’s graphics processing units (GPUs) is surpassing supply, contributing to a more than tenfold increase in stock value since early 2023, currently priced at $181. Analysts forecast that Nvidia’s revenue could rise to $313 billion in fiscal 2027, with earnings expected to increase by 59% to $7.46 per share.

Nvidia plans to launch its next-generation Rubin architecture in 2026, projected to deliver 3.3 times the performance of its current models, further amplifying demand. However, increasing competition from other chipmakers could pose challenges if demand begins to decline.

“`