Can Shopify Join the Ranks of Trillion-Dollar Companies?

In 2018, Apple made headlines by becoming the first U.S. publicly traded company to reach a $1 trillion valuation. Since then, several tech companies, including Microsoft, Alphabet, Amazon, Nvidia, and Meta Platforms, have achieved similar milestones. While this exclusive group remains small, more companies are likely to join in the future. One contender is Shopify (NYSE: SHOP), an e-commerce platform currently valued at $135 billion.

To reach a trillion-dollar valuation, Shopify must maintain a compound annual growth rate (CAGR) of at least 14.3% over the next 15 years. Although challenging, there are strong reasons to believe Shopify can succeed.

Leading with Innovation and Vision

Shopify was founded to help businesses overcome difficulties in setting up online stores. Many early platforms presented design challenges and lacked flexibility. Shopify revolutionized this process by providing merchants with a comprehensive suite of tools—from customizable templates and payment processing to inventory management and marketing solutions.

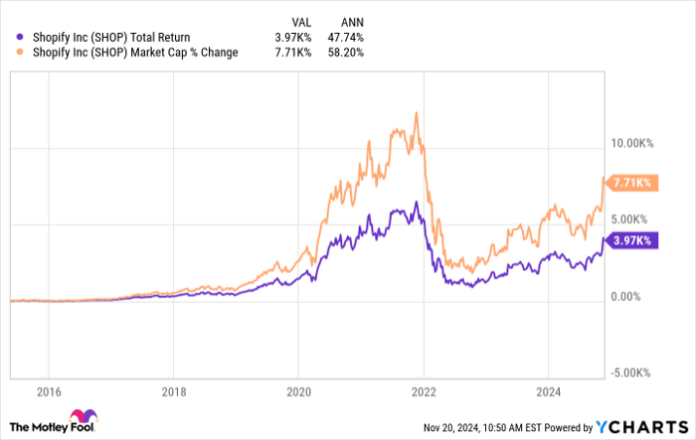

The company’s app store enhances its platform even further, offering thousands of applications that cater to diverse merchant needs. Since going public in 2015, Shopify, led by co-founder Tobias Lütke, has consistently outperformed growth expectations, putting it on track to potentially become a trillion-dollar stock.

SHOP Total Return Level data by YCharts.

Research suggests that founder-led companies in the S&P 500 often outperform their peers. This trend is evident among the existing trillion-dollar firms, most of which are still led by their founders. Although Shopify following this model does not guarantee success, its ambition to become a 100-year company indicates solid planning and direction.

Facing Opportunities and Challenges

Shopify previously struggled with profitability—a concern the company addressed by selling its low-margin logistics business. This strategic shift has improved its financial performance significantly. In the third quarter, Shopify’s revenue increased by 26% year over year to $2.2 billion, with net income rising by 15% to $828 million. The company also reported a 19% free cash flow margin, improving from 16% the previous year.

As a result, Shopify’s stock has seen substantial growth this year. Looking ahead, the e-commerce sector is poised for significant expansion, providing Shopify with considerable opportunities. The platform enables businesses to reach customers they may not have encountered otherwise, streamlining costs that can benefit consumers. Despite its current widespread use, the e-commerce market still has ample room for growth, as online sales accounted for only 16.2% of total U.S. retail sales in the third quarter.

Shopify enjoys a competitive edge due to its extensive app store, creating a network effect that enhances its appeal to both developers and merchants. This ecosystem fosters customer loyalty and makes it challenging for businesses to switch to competitors.

With these attributes—including profitable growth, a long-term vision, and ample opportunities—Shopify has positioned itself well for continued success, aiming to ascend to a trillion-dollar valuation within 15 years.

Is Now a Good Time to Invest in Shopify?

Before investing in Shopify, it’s essential to weigh your options:

The Motley Fool Stock Advisor team recently identified the 10 best stocks to buy now, excluding Shopify from the list. These stocks are expected to yield significant returns in the coming years.

For context, consider that when Nvidia made this list on April 15, 2005, a $1,000 investment would now be worth $869,885!*

Stock Advisor offers an investor-friendly approach, providing guidance on portfolio building, regular updates, and two new stock recommendations each month. Since 2002, the service has more than quadrupled the S&P 500’s returns.*

Discover the 10 stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market (an Amazon subsidiary), is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. Randi Zuckerberg, a former director at Facebook, holds a position on the board as well. Prosper Junior Bakiny has investments in Amazon, Meta Platforms, and Shopify. The Motley Fool currently recommends and holds positions in multiple big tech companies, including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Shopify. The Motley Fool also offers specific options recommendations related to Microsoft. For full disclosures, please see The Motley Fool’s policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.