“`html

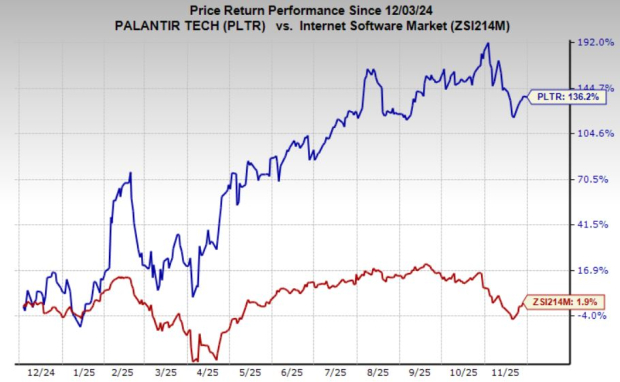

Palantir Technologies Inc. (PLTR) reported a significant 121% surge in U.S. commercial revenues year over year for Q3 2025, fueled by the expansion of its Foundry platform. The platform allows organizations to integrate over 200 data sources, enhancing operational efficiencies across various industries. The company has also experienced a 136% increase in stock value over the past year, outperforming the industry average of 2%.

Foundry, a core component of Palantir’s commercial strategy, utilizes an automated low-code approach to unify both structured and unstructured data. Meanwhile, the older Gotham platform continues to support critical analytics for sectors like defense and healthcare. Palantir’s emphasis on security and analytics has solidified its reputation in enterprise AI and digital transformation.

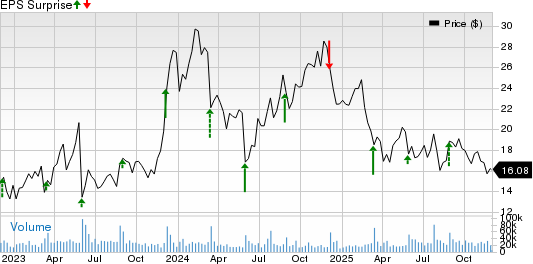

As of now, PLTR trades at a forward price-to-sales ratio of 66.59X, significantly higher than the industry average of 4.87X, indicating robust market expectations. The company holds a Zacks Rank #2 (Buy) as analysts revise 2025 earnings estimates upward.

“`