“`html

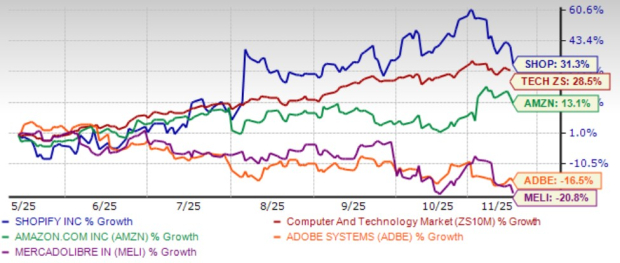

Shopify Inc. (SHOP) shares have increased by 31.3% over the past six months as of Q3 2025, outperforming the Zacks Computer and Technology sector, which grew by 28.5%. In Q3, the company’s gross merchandise volume (GMV) rose approximately 32% year-over-year, while monthly recurring revenues reached a record high.

Shopify’s free cash flow margin improved to 18% in Q3 2025, marking its ninth consecutive quarter of double-digit performance, and the first nine months of the year showed a stable 16% margin. Despite these strengths, the company faces rising competition from Amazon, Adobe, and MercadoLibre, which are expanding their platforms. Notably, Amazon’s “Buy with Prime” and Adobe’s customization capabilities pose significant threats to Shopify’s market share.

Shopify currently trades at a forward price-to-sales ratio of 14.95, significantly higher than the industry average of 7.08, indicating potential overvaluation. As such, investors are advised to hold the stock while assessing ongoing competition and valuation metrics.

“`