“`html

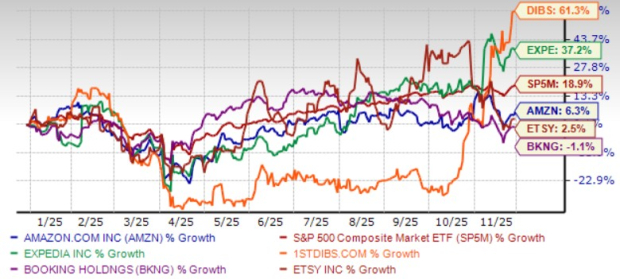

In the three days leading up to Thanksgiving, the S&P 500 rose 1.6%, the Dow increased 2.1%, and the NASDAQ climbed 1.5%, marking the largest Thanksgiving rally since 2012. Small-cap stocks performed particularly well, with the Russell 2000 gaining 5%.

Key factors behind this market surge include diminished short-selling activity. Analysts suggest that this trend marks the beginning of an “early January effect,” potentially paving the way for significant growth in 2026.

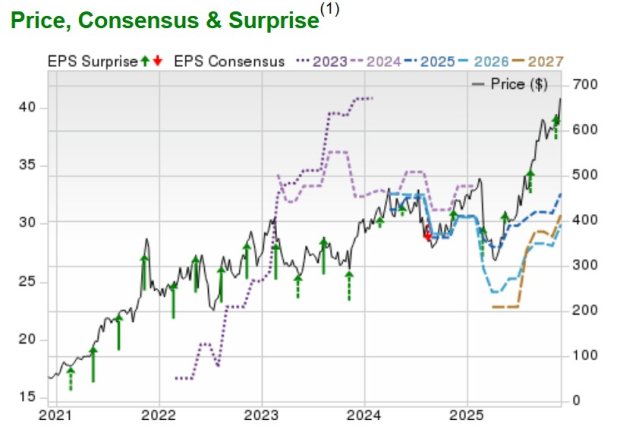

Looking ahead, predictions indicate that the economy could see a 5% GDP growth rate soon, driven by increased efficiency from AI technologies. Investors are encouraged to strategically position themselves for upcoming market changes related to the so-called “Economic Singularity.”

“`