“`html

In 2025, the Vanguard Information Technology ETF (NYSEARCA: VGT) has generated a year-to-date return of 28.77%, building on a 162.63% return over the last five years. The fund holds shares in 316 companies, with over 43% of its assets allocated to three major firms: NVIDIA (17.17%), Microsoft (13.10%), and Apple (13.36%).

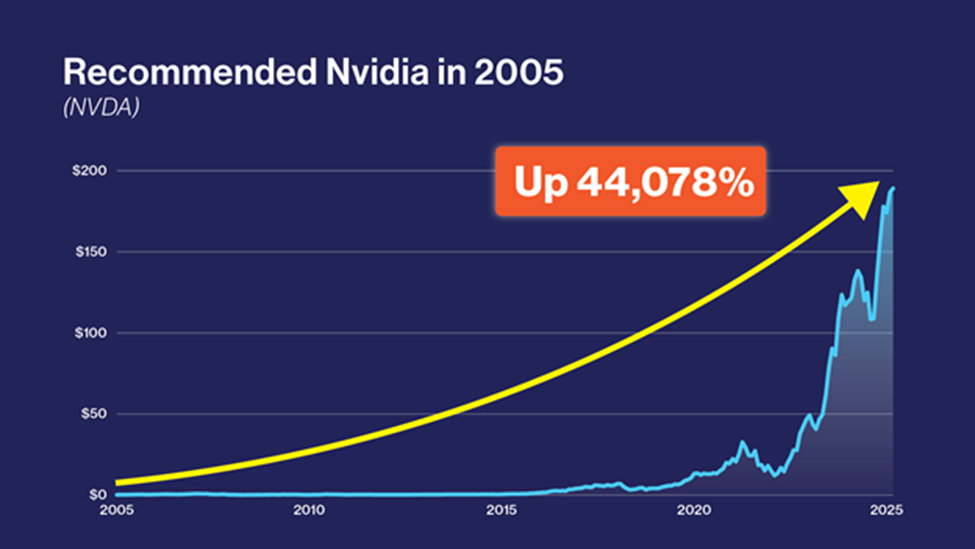

NVIDIA leads in AI chip production, experiencing triple-digit year-over-year growth in its data center revenue. Microsoft benefits from increased adoption of its cloud platform Azure, while Apple’s services division has become a significant revenue generator. Institutional investors have poured over $5.6 billion into VGT over the last year, indicating strong professional confidence.

The ETF’s low net expense ratio of 0.09% contrasts sharply with the 0.63% average for tech-focused ETFs, contributing to better long-term returns for investors. VGT’s diversified structure helps manage risks associated with individual stocks, making it a compelling choice for exposure to the technology sector.

“`