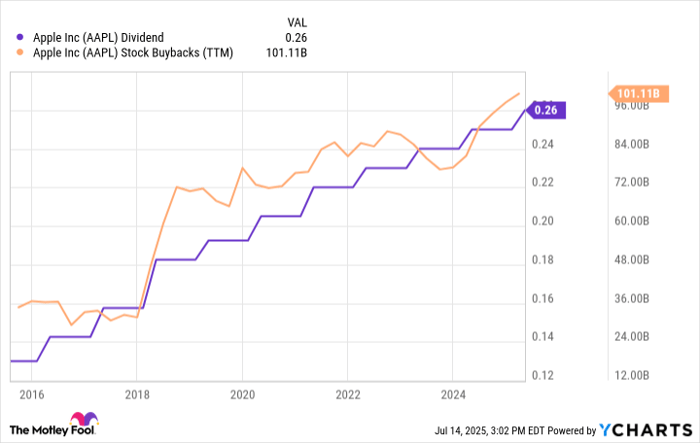

Apple’s Financial Overview

Apple (NASDAQ: AAPL) generates approximately $100 billion in free cash flow annually and intends to return a significant portion to shareholders. Currently, Apple’s dividend yield stands at just 0.5%, compared to the S&P 500’s yield of 1.2%. Despite this lower yield, Apple has consistently increased its annualized dividend payments, which currently total $1.04 per share—a 27% increase from five years ago, and it only pays out 16% of its earnings in dividends.

Share Repurchases and Cash Returns

In fiscal 2024, Apple allocated $95 billion for share repurchases, significantly outpacing its dividend payments of $15.2 billion. The company also authorized an additional $100 billion for share repurchases, reflecting a strong belief in the company’s value. Apple has a history of annual dividend increases since initiating its dividend in 2012, demonstrating its strong cash flow management and commitment to returning cash to shareholders through both dividends and stock repurchases.