Tesla Stock Declines Sharply After Recent Rally Corrections

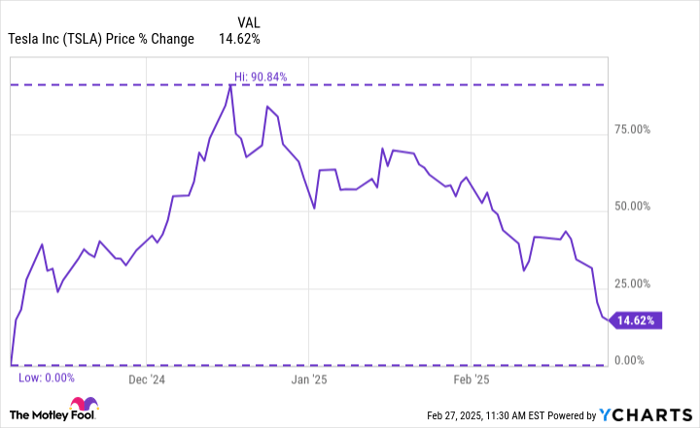

Changes in the market landscape can occur quickly. Following President Donald Trump’s election victory in early November, Tesla (NASDAQ: TSLA) saw its stock price surge. However, that rally has significantly faded, with shares of the electric vehicle manufacturer plummeting nearly 15% for the week as of Thursday at 11:40 a.m. ET.

Impact of European Market Decline

This week’s sharp decline in Tesla’s stock can largely be attributed to poor sales figures in Europe. According to the trade organization Acea, Tesla sales in January dropped by 45% in the European Union and the United Kingdom, despite a marked increase in overall electric vehicle sales in those regions.

Investors are now anticipating that Q1 sales will be the lowest recorded since late 2022. The chart below illustrates the stock’s recent fluctuations:

TSLA data by YCharts

Some analysts suggest that the price drop may stem from investors locking in profits after a significant rally. Additionally, there are concerns that recent political actions by CEO Elon Musk have negatively affected the brand’s perception. A BBC report quoted a former senior director of Tesla’s Europe, Middle East, and Asia division who stated that while politics is “definitely one of the reasons for the decline,” there are numerous compounding factors contributing to the situation.

Valuation Concerns for the Stock

Determining the primary factor affecting Tesla’s stock price is complicated. However, it appears that the company’s valuation may have escalated too quickly. Following the post-election surge, Tesla’s valuation peaked at approximately 194 times forward earnings estimates, which puts it well ahead of competitors in the “Magnificent Seven.” This heightened valuation makes Tesla’s stock particularly vulnerable to setbacks, even with minor negative news. Given the challenges ahead, I remain cautious about tech and AI valuations.

Seize This Investment Opportunity

If you’ve ever felt like you missed an opportunity to invest in successful stocks, consider this a potential second chance.

Our expert analyst team has issued a “Double Down” recommendation for companies they believe are on the verge of substantial growth. If you’re concerned you’ve already passed up your investment opportunity, now may be the ideal time to purchase before it’s too late. The numbers highlight the potential gains:

- Nvidia: If you had invested $1,000 when we issued a double down in 2009, you’d have $340,411!*

- Apple: An investment of $1,000 when we doubled down in 2008 would have grown to $45,570!*

- Netflix: Investing $1,000 during our 2004 double down would now be worth $533,931!*

Currently, we are providing “Double Down” alerts for three promising companies, and this may be a rare opportunity for investors.

Learn more »

*Stock Advisor returns as of February 24, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.