Exploring Less Obvious AI Investments for Future Growth

Investors are flocking to the AI market, with Nvidia leading the charge as one of the world’s most valuable companies. However, some believe that Nvidia’s stock may have risen too quickly and that stronger opportunities exist elsewhere. Here’s why IBM (NYSE: IBM), Micron Technology (NASDAQ: MU), and Fiverr International (NYSE: FVRR) may present better investment options this fall.

Unique Approaches to AI Growth

The companies mentioned above may not be the most traditional choices for AI investments, but they have significant ties to the booming generative AI sector from different angles:

- IBM takes a unique route by concentrating on enterprise-level AI solutions instead of consumer products. With features like auditable data flows, IBM is already securing $3 billion in service contracts for its generative AI platform, launched just two years ago.

- Micron specializes in high-speed memory chips. These chips are essential for the systems that train and operate generative AI and for next-generation smartphones equipped with AI features. As demand for AI-driven technologies increases, so does the need for Micron’s products.

- Fiverr utilizes generative AI in a unique way. The platform connects freelancers with clients and actively incorporates various AI technologies to improve service delivery. Additionally, Fiverr offers AI-related freelance services, which have become a significant growth factor for the company.

|

AI Stock |

2-Year Total Return |

Price to Free Cash Flow |

Forward Price to Earnings |

|---|---|---|---|

|

Nvidia |

848% |

76.5 |

33.9 |

|

IBM |

58% |

15.8 |

20.0 |

|

Micron |

70% |

901.4 |

7.7 |

|

Fiverr |

(18%) |

13.9 |

11.6 |

Data collected from YCharts and Finviz on Nov. 21, 2024.

Valuations Present Possible Opportunities

Since OpenAI launched ChatGPT nearly two years ago, Nvidia has considerably outperformed the stock market. While this has benefited long-term Nvidia investors, the stock’s valuation seems stretched. It is priced for high expectations, which could lead to price corrections if Nvidia fails to maintain its edge in the AI accelerator field.

Conversely, IBM’s upward trajectory in AI is only beginning, and Fiverr has experienced a downturn amid fears that generative AI may threaten freelance jobs. Nevertheless, both companies are quietly building substantial revenue streams in this evolving sector, which could lead to increased stock values in the future.

Micron’s Promising Future Ahead

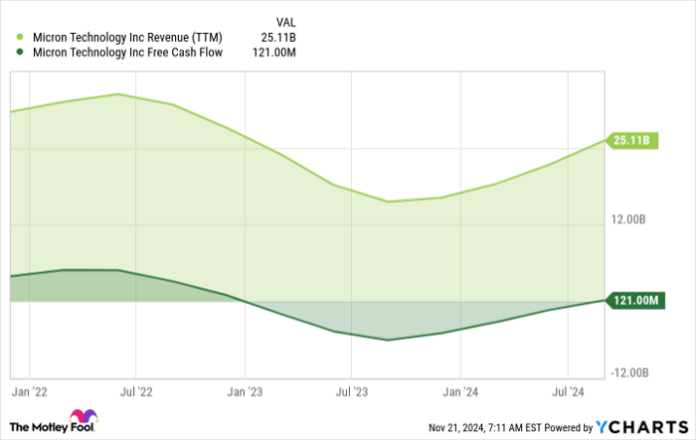

Micron appears out of place in the valuation table above. With free cash flows and trailing earnings showing high multiples, why consider it a “cheap” stock?

The key lies in looking ahead. Micron’s sales growth is rebounding after a slump, and its profitability is recovering:

MU Revenue (TTM) data by YCharts

While current valuation ratios are high, the anticipated future profit trend suggests a more favorable outlook. According to CEO Sanjay Mehrotra, “We are entering fiscal 2025 with the strongest competitive positioning in Micron’s history,” indicating expectations for a significant revenue boost and improved profitability.

A New Chance for Investment

Feeling like you missed out on successful stock investments? Here’s an opportunity to reconsider.

Our analysts occasionally recommend “Double Down” stocks that they believe are primed for growth. If you’re concerned you missed your chance, now may be the ideal moment to invest before the opportunity passes. Here are some past performance highlights:

- Nvidia: a $1,000 investment in 2009 would now be worth $380,291!*

- Apple: a $1,000 investment in 2008 would be worth $43,278!*

- Netflix: a $1,000 investment in 2004 would now equal $484,003!*

Currently, there are alerts for three promising companies, and the chance to invest may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Anders Bylund has positions in Fiverr International, International Business Machines, Micron Technology, and Nvidia. The Motley Fool has positions in and recommends Fiverr International and Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.