Welcome to the unpredictable world of agriculture, where every seed sown is a bet on nature, politics, and global trends. Despite the rise of artificial intelligence, at its core, the industry feeds on the very essence of human existence – food. Research forecasts the agriculture market to grow by a whopping 7.7% yearly, exceeding $19 trillion by 2028.

Diversification is the name of the game in investing, and agricultural stocks and exchange traded funds (ETFs) offer a ripe opportunity to lower risk. Let’s uncover how one particular ETF is reaping the rewards in this bountiful market.

The Untamed Terrain of Agriculture Investment

Agriculture is no serene pasture; it mirrors the untamed wilderness, vulnerable to sudden storms and unforeseen battles. Consumer whims, extreme weather, diseases, and geopolitical turmoil – all factors playing dice with the agriculture industry. Remember the skirmish between Ukraine and Russia? It caused ripples in the commodity supply chain, altering prices of essentials like fertilizers and wheat. Fast forward, today’s headlines scream of cocoa and coffee prices touching the sky while corn and soybeans plummet. This rollercoaster ride of food prices, so erratic that ‘core’ inflation shies away from it, is a risky carnival worth entering. After all, food expenses dominate household budgets and plunge deep into non-core inflation readings.

The DBA Expedition

Embark on a journey into the agriculture horizon with the Invesco DB Agriculture Fund (DBA) as your compass. This ETF lumbers among the heavyweights, managing a hefty $787 million in assets. Commodities like cocoa, live cattle, soybeans, sugar, corn, and coffee fill almost 70% of the fund’s basket – a mix that promises a diversified yield. DBA’s expense ratio may cause a shrug of the shoulders at 0.93%, but peer ETFs scoff with a higher 1.70% ratio. Not just that, shareholders revel in an annualized dividend of $0.96 per unit, fetching a generous forward yield of close to 4%.

The DBA Harvest: A Bounty to Reap

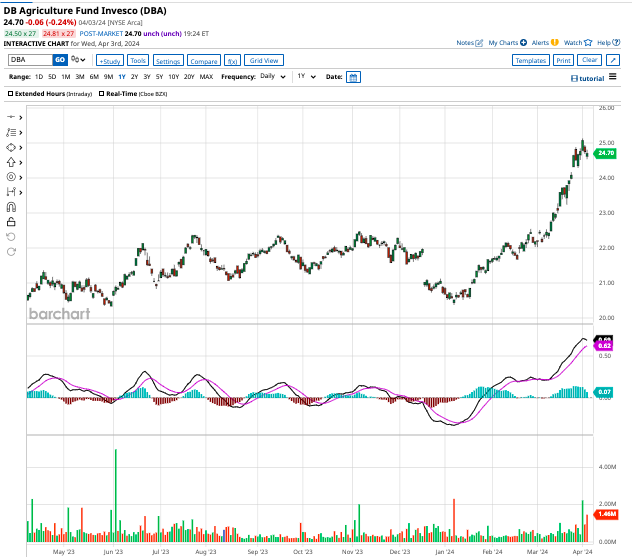

A flash of green in a sea of red – DBA’s shares have sprouted more than 19% in 2024, unlike the S&P 500 Index which managed a modest 9% growth. But wait, the green fields don’t end there. DBA leaves its counterparts trailing with the S&P 500 Tech Sector SPDR (XLK) at 7.7% and the S&P 500 Energy Sector SPDR (XLE) at 15.8%. What magic potion does DBA hold, you wonder?

Cocoa prices dancing on new highs, closing in on $10,000 per metric ton paint a pretty picture, thanks to supply constraints. Ivory Coast and Ghana, the global cocoa bean titans, grapple with unforgiving weather, leading to the scarcity. The DBA ETF clocks a handsome 26% gain within a year, riding high on the cocoa wave. Coffee too isn’t far behind, with arabica and robusta futures scaling new heights amidst Brazil and Vietnam woes.

The agriculture market dances to the rhythm of unpredictability, a jittery waltz governed by an invisible hand. But for investors seeking shelter from the storm of rising commodity prices and food inflation, DBA stands tall as a beacon in these turbulent times.

On the publication date, Aditya Raghunath held no positions, directly or indirectly, in any mentioned securities. All data and information are for informational purposes only. View the Barchart Disclosure Policy for more details.

The opinions expressed are solely those of the author and do not reflect those of Nasdaq, Inc.