Market Weakness Presents Bargain Opportunities for Nvidia Investors

The market faces challenges as concerns about a potential trade war grow. This uncertainty has led to price declines in many stocks over recent days, creating opportunities for savvy investors. One standout stock is Nvidia (NASDAQ: NVDA), which has fallen to attractive prices.

Nvidia’s stock has experienced significant price adjustments, yet historical performance suggests it could bounce back once the market stabilizes. Therefore, investors should consider seizing the current selling opportunities to acquire Nvidia shares while they remain at appealing price levels.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia’s GPUs: Essential in the AI Race

Nvidia produces graphics processing units (GPUs) and supporting infrastructure like its CUDA software. These GPUs are critical today due to their parallel computing capabilities. They can also be clustered to enhance compute power, making them ideal for demanding applications requiring substantial processing resources.

Artificial intelligence (AI) is currently the primary consumer of GPUs, driving relentless demand for Nvidia’s products. Major tech companies have announced record capital expenditures for 2025, with a significant portion allocated to Nvidia. This trend indicates a growing reliance on AI, prompting companies to bolster their GPU reserves, thereby benefiting Nvidia.

Despite strong indicators for growth, some investors express concern that potential tariffs may disrupt Nvidia’s trajectory. Nvidia’s management acknowledged uncertainty regarding the impact of tariffs due to insufficient clarity from the U.S. government.

A majority of Nvidia’s components are sourced from Taiwan. However, recent announcements from Taiwan Semiconductor Manufacturing regarding substantial new facilities in the U.S. ($100 billion investment) may mitigate these tariff risks. This initiative could gradually transition Nvidia’s supply chain to U.S.-based production.

While Nvidia itself may not be directly impacted by tariffs, overarching economic impacts could potentially reduce spending, leading companies to minimize discretionary expenses. However, Nvidia’s GPUs represent critical infrastructure for AI and cloud computing, positioning their expenditure as essential rather than discretionary.

Despite prevailing fears, Nvidia provided strong financial guidance for the first quarter, indicating confidence in its resilience to tariff-related issues. This positive outlook suggests that concerns affecting Nvidia may be exaggerated.

Nvidia’s Valuation Reflects Strong Growth Potential

For its fiscal Q1 2026 (ending around April 30), Nvidia forecasts revenue of $43 billion, a 65% increase year-over-year. This significant growth is likely to continue as the demand for AI accelerates. Analysts predict overall revenue growth of 56% for FY 2026, pushing Nvidia’s revenue beyond $200 billion.

Although short-term headlines about trade wars can distract investors, the long-term implications of AI development are far more substantive. Focusing on industry trends over the next five years rather than immediate fluctuations reveals an attractive valuation for Nvidia stock.

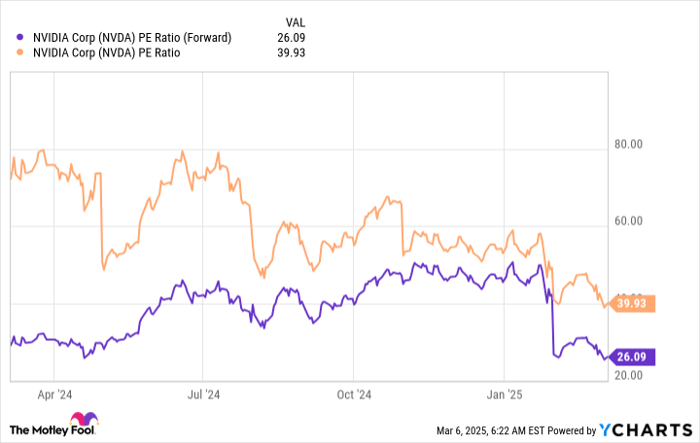

NVDA PE Ratio (Forward) data by YCharts

Nvidia’s stock trades at 40 times trailing earnings and 26 times forward earnings, indicating a pricing level that many would consider exceptionally low, given the company’s robust growth trajectory.

With overarching fears being the only significant headwind, now is an opportune moment for investors to consider acquiring shares, especially with a long-term perspective of up to five years in mind.

Should You Invest $1,000 in Nvidia Now?

Before making an investment in Nvidia stock, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks for investors to buy right now—Nvidia did not make this list. Instead, the selected stocks could yield substantial returns in the coming years.

Reflect on the performance of Nvidia when it was first recommended on April 15, 2005. A $1,000 investment at that time would now be worth $690,624!*

Stock Advisor offers investors a comprehensive strategy for success, including portfolio-building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002.* Don’t miss out on the latest top 10 list available upon joining Stock Advisor.

*Stock Advisor returns as of March 10, 2025

Keithen Drury holds positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.