The stock market, ablaze with the fever of artificial intelligence (AI)-driven growth, has recently been enraptured by Nvidia’s (NVDA) latest earnings spectacle. However, as the curtains draw to a close on the corporate earnings season, and stocks shimmer tantalizingly near their zenith before a pivotal payrolls report looms on the horizon, investors would do well not to overlook the allure of defensive stocks – those resilient entities that proffer good value, unwavering performance through economic ebbs and flows, and steadfast demand.

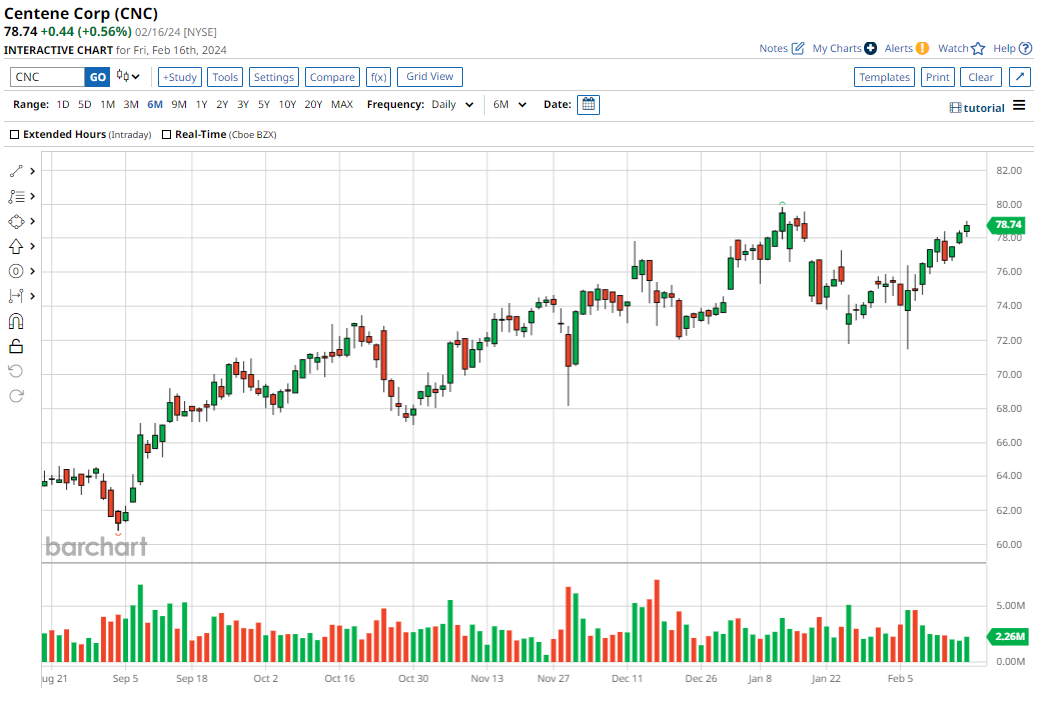

Within this dynamic milieu, a name that gleams with potential is Centene Corporation (CNC), an illustrious figure in the healthcare realm. While Centene may not promise the soaring heights of a Magnificent Seven-style growth narrative in the coming years, it stands robustly positioned to reap the rewards of the industry’s paradigm shift towards value-based care and digital metamorphosis. Moreover, buoyed by a resplendent Q4 earnings triumph, Centene is poised to furnish steadfast gains in both EPS and revenue in the foreseeable future.

Celestial Performance in Q4 Earnings

Crowned with a market capitalization of $42.8 billion, Centene reigns as a purveyor of healthcare services through government-sponsored programs. Its dominion extends across the Managed Care segment, encompassing Medicaid, and the Specialty Services domain, which collaborates with institutional and commercial clienteles.

In its grand reveal on February 6, Centene unveiled its Q4 2023 earnings extravaganza. Surpassing analysts’ anticipations, the adjusted EPS of $0.45 sparkled brightly, as did the quarterly revenue of $39.46 billion. A spectacular totality of premium and service revenues, amounting to $35.3 billion for the period, contributed to an annual revenue sumptuousness of $153 billion. Gliding through the fiscal year 2023, the establishment reported adjusted profits per share of $6.68, a regal progression from the antecedent year’s figure of $5.78.

Forthcoming into 2024, Centene continues to anticipate an adjusted EPS no less than $6.70. Furthermore, the entity has embellished its 2024 premium and service revenue prophecies by an additional $2.5 billion, stretching the range between $134.5 billion and $137.5 billion.

In a flaunt of fealty to enhancing shareholder value, Centene undertook $1.6 billion worth of share repurchases during 2023. The establishment concluded 2023 adorned with $17 billion in cash and fluid assets, empowering its pursuit of forthcoming investments and developmental odysseys.

Analyst Alchemy: Expectations for CNC

Gazing beyond the current horizon, seers project CNC’s EPS to ascend by 1.29% to $6.77 in fiscal year 2024, with a more robust jump of 12.1% to $7.59 in fiscal 2025. Revenue, though predicted to wane by about 5% this year, is anticipated to pirouette back into growth mode in fiscal 2025, pirouetting upwards by 4.79% to $152.68 billion.

While the prediction for revenue appears relatively tepid in comparison to its healthcare sector compatriots, the crescendo of EPS growth at CNC is set to outshine its rivals by a substantial margin.

Striking a Chord: The Denouement for CNC Stock

In summation, with its beguiling valuation, robust bottom-line performance, and buoyant revenue prognostications, CNC emerges as a knightly choice for investors seeking to infuse their portfolios with diversity and fortify their defenses. While the stock may not dazzle with the tumultuous promise of AI stocks, its serene stability might just be yet another jewel in the crown for Centene’s future ascension.

As of the publication date, Faizan Farooque had no direct or indirect positions in any of the securities referenced in this article. The information and data contained herein are purely for informational purposes. For further elucidation, kindly refer to the Barchart Disclosure Policy here.

The expressions and viewpoints delineated herein are those of the author and do not necessarily mirror those of Nasdaq, Inc.