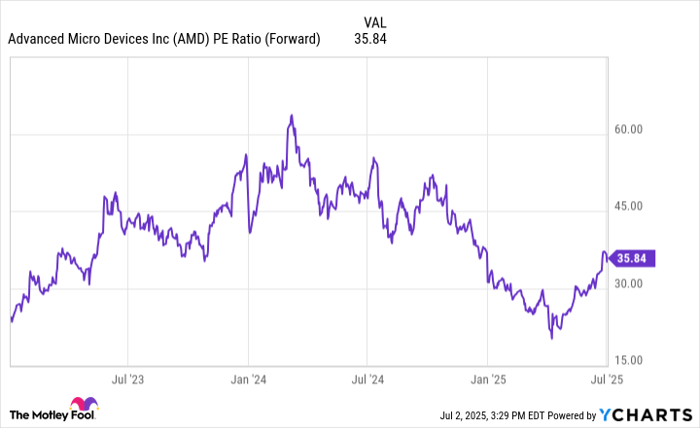

MercadoLibre (NASDAQ: MELI) might not be a household name in the U.S., but savvy investors know that this e-commerce stock has been a top performer in the online retail sector throughout its history.

In fact, it’s even outperformed Amazon since its 2007 IPO, and both stocks have dwarfed the returns of S&P 500 during that time frame.

MELI data by YCharts

Like much of the e-commerce sector, MercadoLibre stock plunged in 2022 in the bear market, but unlike most of its e-commerce peers, MercadoLibre’s business continued to put up strong growth, seeing demand continuing to surge even after the tailwinds from the pandemic had passed.

MercadoLibre has rebounded since then, recouping much of those losses, but the stock is still down about 15% from its pandemic-era peak. With the S&P 500 and the Nasdaq Composite back at record highs, it seems reasonable to expect MercadoLibre stock to touch new heights as well.

Let’s take a closer look at MercadoLibre and why the stock is a buy today.

Image source: Getty Images.

What is MercadoLibre?

MercadoLibre is best known as an online retailer, but the business is much more than that.

The company operates as a direct online retailer, selling goods it owns through its website, and it operates a third-party marketplace, allowing individual sellers to sell merchandise on its platform, for which it collects a commission. It’s the same e-commerce model that has made Amazon so successful.

MercadoLibre operates across Latin America, but nearly all of its business comes from Brazil, Argentina, and Mexico. Brazil is its biggest market, representing about half of its revenue.

In addition to the core e-commerce business, the company also owns MercadoPago, a digital payments and fintech business, that has emerged as arguably the most valuable part of the company. In addition to serving as a payment platform, MercadoPago also offers point-of-sale devices to merchants of brick-and-mortar stores across Latin America, where digital payment technology is not as developed as in the United States. That business has allowed MercadoLibre to tap into the massive physical retail market in Latin America.

In addition to its two main businesses, e-commerce and fintech, the company also runs its package delivery service, MercadoEnvios, strengthening its competitive advantage as most of its sellers use MercadoEnvios to ship their orders. Finally, the company also has its own credit business, MercadoCredito, lending money to its sellers and other borrowers, and an asset management called MercadoFondo.

Like Amazon, MercadoLibre has built an interconnected network of businesses that complement each other and create a wide economic moat. Not only is MercadoLibre growing rapidly, but its margin is also expanding. The company has proved itself against competition such as Amazon and Sea Limited‘s Shopee.

Is MercadoLibre a growth stock?

MercadoLibre has been one of the fastest-growing stocks in the e-commerce sector, and that pattern was on display in its first quarter.

Revenue rose 36% to $4.3 billion and was up 94% on a currency-neutral basis, as the devaluation of the Argentine peso impacted reported results. Gross merchandise volume rose 71% on a currency-neutral basis to $11.4 billion, and total payment volume jumped 86% adjusted for currency.

Operating margin came in at 12.2%, which the company said rose 120 basis points after adjustments to year-over-year comparisons.

MercadoLibre is growing quickly, and the company has a lot of room to grow in Latin America, penetrating the region further and adding new businesses.

Why MercadoLibre stock is a buy

The company has a long history of outperforming the stock market and gaining market share, and it’s growing profit margin with add-on businesses like advertising and credit and by scaling its core businesses, such as the marketplace and MercadoPago.

With profit margin improving, the stock looks about as cheap as it’s ever been, at a forward P/E of 50. Investors can take advantage of the discount from its peak by buying the stock now.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon, MercadoLibre, and Sea Limited. The Motley Fool has positions in and recommends Amazon, MercadoLibre, and Sea Limited. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.