Are you a fan of bargain shopping in the stock market? If so, consider investing in the burgeoning coffee chain powerhouse, Dutch Bros (NYSE: BROS). Despite taking a significant 56% dip from its peak in 2021, Dutch Bros is showing signs of recovery and potential for future growth. The narrative of Dutch Bros’ trajectory is captivating, with investors beginning to believe in a sustained exceptional growth trajectory for the brand.

But let’s start from the beginning.

The Dutch Bros Phenomenon

For those unfamiliar with the company, Dutch Bros currently runs 830 drive-thru coffee stands spread across 16 states, clocking in a revenue of $254 million during the last quarter of 2023.

It operates in a competitive landscape with giants like Starbucks (NASDAQ: SBUX) and indirect competitors such as McDonald’s (NYSE: MCD) having a formidable presence. However, Dutch Bros sets itself apart by offering a highly personalized experience to its customers. The company’s commitment to a “people-first culture” shines through in its strong community engagement and personalized service.

Image source: Getty Images.

The company’s financial performance corroborates this customer-centric approach, with a 26% year-over-year increase in revenue last quarter, driven by both same-store sales growth and new store openings. Dutch Bros’ ambitious expansion plans aim to hit around 4,000 stores eventually.

The Competitive Edge of Dutch Bros

While major players like Starbucks have set high standards in coffee consumption experiences, smaller players like Dutch Bros carry their weight through a personalized touch and authenticity that resonates with today’s consumers.

Younger demographics favor authentic brands like Dutch Bros over large corporate entities, giving the chain an edge in the market. Founded in the early 1990s, Dutch Bros has a unique appeal to millennials and Gen Z, positioning it as a brand relevant to younger consumers with rising disposable incomes.

The Recovery: Finding Solid Ground

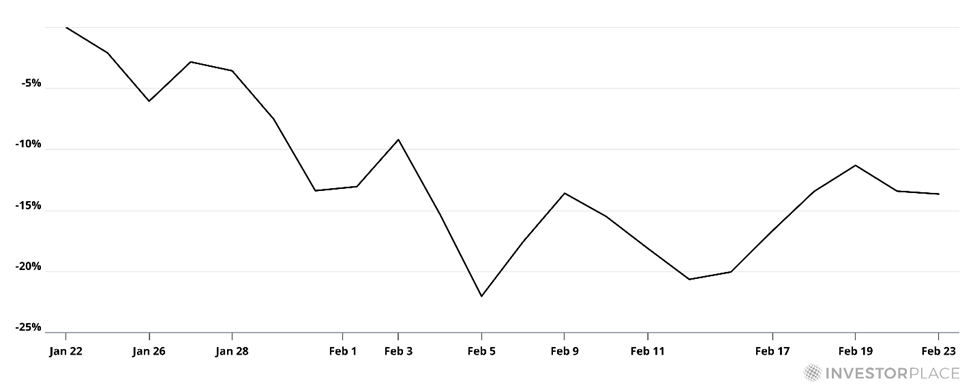

So why has Dutch Bros stock plummeted by nearly 60% from its 2021 peak? The answer lies partly in the circumstances surrounding its IPO in September 2021. The stock rode a wave of optimism during the height of the pandemic, surging from $23 to a peak of $81.40.

However, as market exuberance waned amidst the 2022 bear market, Dutch Bros’ stock took a hit. Nonetheless, the recent rebound of over 40% from the 2024 low indicates a potential turnaround in sentiment, with the market recognizing the underestimated potential of the company.

This common post-IPO phenomenon has led to an undervaluation of Dutch Bros, presenting an attractive opportunity for investors looking for growth potential.

Should You Brew Up Some Dutch Bros Stock?

As enticing as Dutch Bros’ growth story may sound, it’s crucial to weigh the risks. The company is in a growth phase, with significant spending on expansion plans. The recent issuance of 8 million new shares could lead to increased volatility for existing shareholders.

If you can stomach the risks and volatility, Dutch Bros presents a compelling opportunity for above-average returns.

Is Dutch Bros the right stock for you?

Before diving into Dutch Bros, consider this: the Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks for investors right now. While Dutch Bros isn’t on that list, these top picks hold the potential for significant returns in the years to come.

Stock Advisor offers a roadmap for successful investing, providing insights on building a robust portfolio and delivering two new stock picks monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than triple*.

Discover the 10 stocks

*Stock Advisor returns as of March 21, 2024

James Brumley holds no positions in the mentioned stocks. The Motley Fool has positions in and recommends Starbucks. The Motley Fool follows a strict disclosure policy.

The author’s views and opinions are their own and do not necessarily reflect those of Nasdaq, Inc.