Etsy (NASDAQ: ETSY) runs an online marketplace for unique handmade and customizable goods. Despite facing a decline in sales and profits, the company’s stock presents a compelling buy opportunity in the current market climate.

For long-term investors in Etsy, the journey has not been smooth sailing. Those who entered the stock at its peak two-and-a-half years ago find themselves staring at a staggering 78% loss on their initial investment – a bitter pill to swallow.

While the path to profitability may be uncertain, the allure of Etsy lies in its robust business model, capable of generating significant cash flow – a key factor for rewarding shareholders in the long run. The potential for investors to reap the benefits of this model only grows stronger with the passage of time.

The Strength of Etsy’s Business Model

One of the vital metrics tracking Etsy’s e-commerce ecosystem is its gross merchandise sales (GMS) – the total value of transactions on the platform. While the company achieved a noteworthy GMS of $13.5 billion in 2021, subsequent years have seen a slight decline. However, the foundation of Etsy’s success lies in its ability to attract and retain a robust user base.

Unlike traditional retailers, Etsy’s role as a facilitator of third-party transactions means that different performance indicators come into play. The active buyers on Etsy’s platform reached a record high of 92 million in the last quarter, showcasing the platform’s continued appeal to consumers and sellers alike.

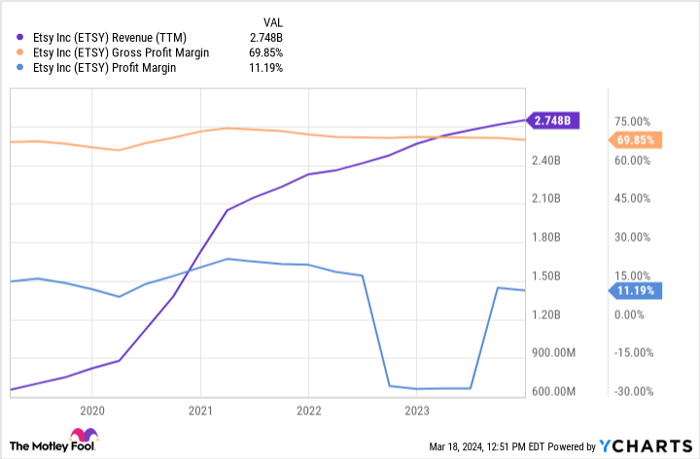

Despite a minor dip in GMS, Etsy continues to display resilience in growing its revenue through avenues like advertising. This adaptability is a hallmark of marketplace businesses, allowing them to pivot and find alternative revenue streams even in the face of static transaction volumes.

The high-margin business model adopted by Etsy is another feather in its cap. With a gross profit margin of 70% and a net profit margin of around 11% in 2023, the company’s financials, while not at their peak, still shine brightly. These figures underscore the inherent strengths of Etsy’s operating framework.

Future Prospects for Etsy

Embracing the power of artificial intelligence (AI) presents Etsy with opportunities to revitalize its sales. The platform’s growing base of sellers offers a myriad of products, making search optimization a significant challenge. However, Etsy’s foray into utilizing AI to enhance user experience is a step in the right direction.

Of particular interest is Etsy’s strategic focus on gifting, a segment ripe with potential recurring revenue. By positioning itself as a go-to destination for gifting occasions, Etsy aims to drive more traffic to its platform, with AI serving as the enabler in guiding users to curated gift selections.

While Etsy works towards expanding its top-line growth avenues in the future, its current cash flow dynamics remain robust, with the company generating $666 million in free cash flow in 2023. This financial strength allows management to reward shareholders through share buybacks, a strategy that enhances shareholder value.

With Etsy’s market capitalization currently standing at $7.9 billion, a mere 12 times its free cash flow, the stock presents an undervalued proposition. The company’s proactive approach to reducing share count through buybacks not only underscores management’s confidence but also provides an additional lever for enhancing shareholder returns.

In the realm of investments, timing and context are key considerations. Despite the plateauing sales trend, Etsy’s favorable cash generation and strategic buyback initiatives position the stock as an attractive investment opportunity. As the market gradually comes to recognize Etsy’s true worth, shareholders stand to benefit significantly from this undervalued gem.

Considering an investment in Etsy?

Before diving into Etsy stock, it’s crucial to weigh your options:

The Motley Fool Stock Advisor team has curated a list of the 10 best stocks poised for exceptional growth, and Etsy may not be among them. This exclusive list showcases stocks primed to deliver substantial returns in the foreseeable future.

Stock Advisor offers a roadmap to investment success, including expert advice on portfolio construction, regular analyst updates, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 by a significant margin*

Explore the 10 compelling stock picks

*Data as of March 18, 2024

Jon Quast holds positions in Etsy. The Motley Fool has invested in and endorsed Etsy. The Motley Fool upholds a transparent disclosure policy.

The thoughts expressed here are solely those of the author and may differ from the opinions of Nasdaq, Inc.